Indian equity benchmarks Sensex and Nifty50 recovered much of their initial losses after a gap-down start in a volatile session on Thursday, a day after official data showed India's GDP expanded 13.5 percent in the April-June period, slower than what the Street had anticipated.

Many analysts are banking on healthy domestic demand though some highlight lower agricultural sowing and a tighter interest rate environment amid a global slowdown.

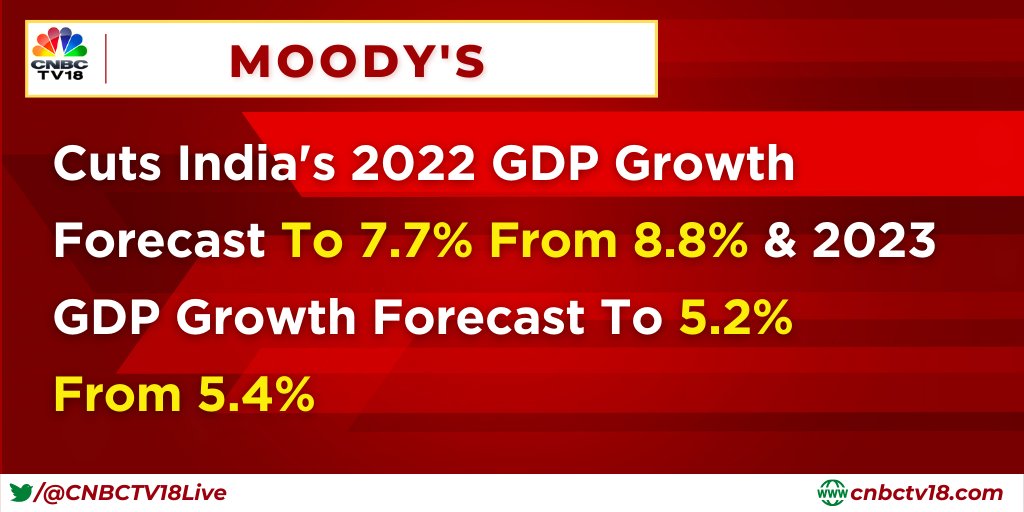

That even as Moody's lowered its 2022 GDP growth forecast for the country by 100 bps.

The overall GDP print is decent and the dip in the market along expected lines, according to Unmesh Sharma, Head Institutional Equities at HDFC Securities.

"In this long and arduous fight against inflation, the market will continuously face very high volatility... One should lighten their portfolios and move away from high risk or long duration assets as far as possible," he told CNBC-TV18.

Growth in the key agriculture, manufacturing, and financial, realty and professional services spaces improved. The three account for 14.3 percent, 17.6 percent and 25.6 percent of India's GDP respectively.

The robust GDP numbers were on expected lines given the low base of the year-ago period as well as a recovery in key industries and services, said Lakshmi Iyer, Chief Investment Officer (Debt) & Head Products Kotak Mahindra AMC.

"Key to note are potential global growth slowdown headwinds that could linger on in terms of domestic sentiments,” she said.

CLSA actually raised its GDP growth estimate for the economy for the current financial year. The brokerage — which had estimated India's GDP to grow 14.3 percent in the quarter — however, warned that the slowdown will continue on account of lower sowing in the kharif (summer-sown) season, higher interest rates and slowing growth in the US.

The brokerage, however, raised its real GDP growth estimate for India for the year ending March 2023 by 10 basis points to 6.8 percent and retained its forecast for the next year at 5.5 percent.

Morgan Stanley said the latest GDP data creates a downside risk of 40 basis points to its growth estimate for the country for the year ending March 2023. However, it said the domestic demand environment in India is relatively healthy.

India's quarterly GDP reading was sharply lower than Citi's estimate of 18 percent growth. It lowered its GDP forecast for the year ending March 2023 to 6.7 percent from eight percent.

The brokerage, however, said demand in the economy is better than what is reflected in the headline GDP print.

(Edited by : Sandeep Singh)

First Published: Sept 1, 2022 4:02 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Mark Mobius sees immense potential for India in tech innovation and manufacturing

May 15, 2024 5:21 PM

INDIA bloc will win majority seats in Bihar, says Tejashwi Yadav

May 15, 2024 4:20 PM

Lok Sabha Election 2024 — how regional parties are challenging national giants in Phase-4

May 15, 2024 6:17 AM

Supreme Court refuses plea seeking 6-year poll ban on PM

May 14, 2024 7:14 PM