It's official! India is now a consensus OVERWEIGHT market for foreign portfolio investors (FPIs). Analysis of a survey done by the global fund flow tracker, EPFR, across 57 emerging market fund managers found that the Indian market comes out on top for this group.

Technically, 'consensus overweight' is when a 'Market where more funds are meaningfully overweight relative to those that are meaningfully underweight'.

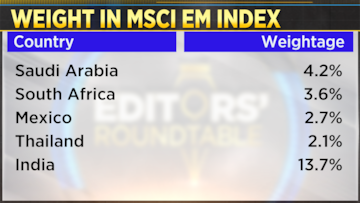

The MSCI Emerging Markets Index is one of the oldest and most widely followed benchmarks for emerging market investors — with over $1.3 trillion in assets under management benchmarked to their emerging markets indexes. Global investors use the MSCI EM Index to allocate their corpus to specific emerging markets. India has the third highest weight in the MSCI EM Index, with a 13.7 percent weight.

When global EM funds get money from investors, the fund manager may decide to allocate, according to a market's weight in the index. He/She may also decide to allocate more or less vis-a-vis the weight in the benchmark, depending on her view on the specific market. India right now is punching above its weight — i.e., it is getting a larger share as compared to the weight it commands in the index.

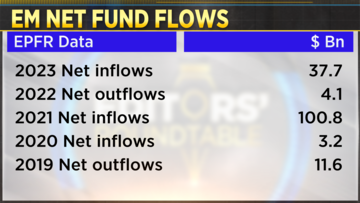

To be sure, emerging market funds themselves are receiving a lot of money this year. While it is often argued that allocations away from China benefit markets like India, and it's true to some degree, one should not stretch this argument too far. China has the largest weight in the MSCI EM Index & it is also the largest EM market. So, a positive view on emerging markets — means flows into China, but also India.

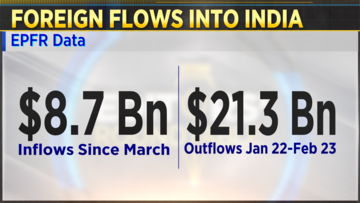

While FII inflows into India have been strong, the fact is, only around half of the money which left India has come back so far.

The other important piece in all of this is earnings, which must pick up. In the Q4’23 earnings season, while 60 percent of the Nifty Midcap universe beat expectations, 51 percent of these companies still saw earnings downgrades to their FY’24 estimates. JP Morgan analysts say that this is a function of high starting expectations. It says that ‘the beats are effectively not surprises’. They add that the majority of the recent rally is on account of higher P/E multiples.

So, while India remains a preferred market globally, it must also lift the burden of high expectations! As S. Naren, who oversees nearly $70 billion in assets at ICICI Prudential AMC, told us in a conversation – while India remains the best structural story in the world, this also means that there are very few sectors where valuations are now cheap.

First Published: Jun 2, 2023 8:04 PM IST