Foreign portfolio investors (FPIs) remained net sellers of Indian shares for the fifth day in a row on Tuesday — the longest chain of daily outflows for Dalal Street since July 23 and the heaviest since July 4. They pulled out a net Rs 13,795.5 crore from Indian equities over a period of five trading days till September 27, according to provisional exchange data.

Though domestic institutional investors (DIIs) made net purchases to the tune of Rs 8,137.6 crore during this period, the rapid outflows on the Street by their foreign counterparts raises a red flag for nascent hopes of sustained inflows — something that powered a liquidity-driven run in the Indian market that lasted 18-odd-months till October 2021.

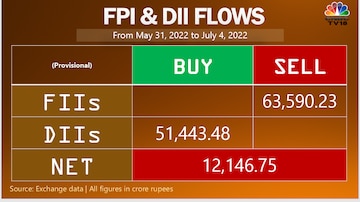

In value terms, the five-day selling spree by FPIs translates to the worst outflow for Dalal Street since their withdrawals of Rs 63,590.2 crore over a 25-day period of back-to-back selling that ended on July 4, according to the data.

The reversal in the bullish trend comes at a time when a global sell-off — with Wall Street indices already in the bear zone — has sent shockwaves to the Indian market amid persistent concerns about steep hikes in COVID-era interest rates and about slowing growth.

The latest leg of FPI selling also comes close on the heels of many experts flagging froth created by elevated levels of equity valuations.

Last month, the IMF and the World Bank warned of a global recession.

All eyes on the verdict from the RBI's rate-setting panel due at the end of three-day deliberations on Friday for domestic cues. The central bank is widely expected to hike the repo rate — or the key rate at which lends to commercial banks — by 50 basis points to 5.9 percent on September 30.

If that happens, it will be a little more than a week of the Fed announcing a 75-basis-point hike in key US rates, taking the overall increases to 300 bps since March over five revisions.

Indian equity benchmarks Sensex and Nifty50 have receded almost three percent so far in 2022 in the ongoing sell-off, after turning negative for the year last Friday. Banking and financial services stocks are a major contributor to the current fall amid a series of unprecedented lows against the US dollar thanks to 20-year highs in the greenback against six other peers.

"In search of a safer dollar and elevated bond yields, foreign investors are withdrawing from Indian equities, resulting in the decline of the domestic market," said Vinod Nair, Head of Research at Geojit Financial Services.

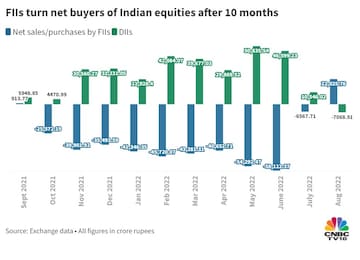

The fall in the market comes within months of the main indices escaping what experts were calling one of the slowest bear markets of all time.

Though the worst of FII outflows appears to be behind, the pace of inflows is not sustainable, Ambit Capital Co-Head of Equities Dhiraj Agarwal told CNBC-TV18.

In August, FPIs emerged net buyers for calendar month for the first time since since September 2021, making net purchases to the tune of Rs 22,026 crore, according to exchange data.

ALSO READ: 'Chakravyuh' moment in Indian market

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM