Fortis Healthcare shares closed over a percent lower ahead of the announcements of its first-quarter earnings, which are likely to see a 60 percent year-on-year (YoY) fall in profit owing to lower COVID-19-related sales as the Omicron wave settles and high base.

The stock ended 1.29 percent lower at Rs 264 per share on BSE. The stock has gained 10.28 percent in the last month while it has fallen 11 percent this year so far. In the past year, the stock has gained 8.74 percent, outperforming the Sensex by 1.59 percent.

*as of July 27, 2022.

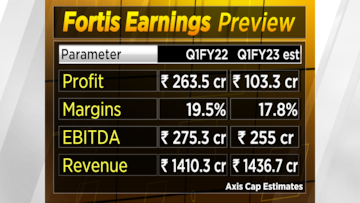

*as of July 27, 2022.According to Axis Capital's estimates, revenue is likely to grow 2 percent to Rs 1,436.7 crore, while earnings before interest, taxes, depreciation, and amortisation or EBITDA — a measure of a company's overall financial performance — is likely to fall by 7.3 percent.

The decline would be mainly due to exceptional COVID-related business amid a surge in cases last year.

The margin is likely to decline by 1.7 percent while the profit is expected to be at Rs 103.3 crore versus Rs 263.5 crore in the first quarter of FY22.

Sequentially, the revenue is expected to rise by 4.3 percent and EBITDA is likely to grow by 15 percent. The margin could be higher by 1.8 percent while profit is likely to be up 18.6 percent as occupancy levels recover from the impact of COVID-19.

Occupancy levels are expected to be around 66 percent in the first quarter against 59 percent in the last quarter.

The diagnostic business, however, is expected to scale off due to lower COVID-19-related sales compared to a year ago, impacting margins. Diagnostic margins are expected at 22.5 percent versus 26 percent quarter-on-quarter.

Overall, growth is expected in the hospital business as the impact of COVID-19 reduces and international medical tourism normalises.

Among the key things to watch out for will be management commentary on capex, average revenue per bed, outlook on competition in the diagnostics space, and updates on open offers.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM