Foreign Portfolio Investors are warming up to India's midcaps yet again. After declining for five years in a row, foreign ownership of Indian midcaps has increased by 175 basis points in 2023, according to a Goldman Sachs note.

Data from the Goldman Sachs note shows an increase in foreign ownership of Nifty Midcap 100 stocks after falling even below the Covid-19 lows last year. However, the ownership remains below pre-pandemic levels.

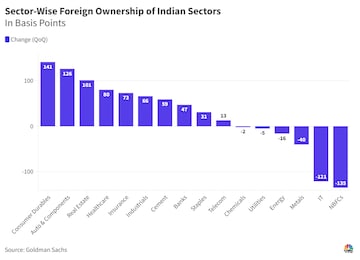

Consumer Durables, Auto & Auto Components, Real Estate, Healthcare and Insurance make up the top five sectors where FII ownership has increased in the June quarter compared to March. Sectors where foreign ownership has declined in the June quarter include NBFCs, IT, Metals & Mining, and Energy. A caveat here is that most of the NBFC decline is led by HDFC Ltd., before its merger with HDFC Bank.

Indian equities saw foreign inflows of nearly $14 billion in the June quarter. However, FII ownership in the BSE 200 index has risen only by 10 basis points, slower than the broader market.

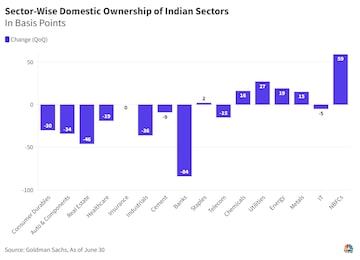

Conversely, ownership of Domestic Institutions in Indian equities declined by 30 basis points during the June quarter. Most of the decline came in banks, healthcare, industrials, autos and consumer durables, nearly the same sectors in which foreign investors have increased their ownership. Although domestic ownership of BSE 200 companies dropped by 10 basis points in the June quarter, it remained at a historical high of 8.9 percent.

Direct retail ownership of Indian equities declined through most of 2022, but has increased over the last two quarters. It is now approaching the previous 10-year highs of 9.6 percent. Retail ownership of NSE Smallcap 100 stocks gained 20 basis points in the June quarter after falling 140 basis points in March. It continues to remain significantly below the last three-year average of 16 percent.

Yes Bank, Federal Bank, Zee Entertainment, Voltas and Biocon are the top five retail-owned stocks in India as of the June quarter. On the other hand, Max Healthcare, Shriram Finance, Axis Bank, AU Small Finance Bank and Sona BLW Precision are the top five foreign owned names.

First Published: Aug 18, 2023 6:43 AM IST