The domestic Fast Moving Consumer Goods (FMCG) sector is poised for a big recovery in 2023 as inflationary pressure is easing and several positive factors are expected to boost the consumption demand, according to FMCG major Marico’s latest quarterly report. FMCG stocks are already witnessing an upward trend and the shares of leading players in the sector like HUL, Nestle, Britannia, Tata Consumer and Godrej Consumer Products are on a gaining streak.

Further, key positive factors are validating an encouraging demand environment as urban demand sustains steady growth, while higher crop realisations boost the rural demand.

According to Marico's commentary on the demand environment, the FMCG sector witnessed some improvement in demand in the third quarter (Q3) of FY23 owing to key factors such as urban and premium categories maintaining their steady pace of growth, recovery in rural demand was not as discernible in Q3 and visible recovery in December as consumer pricing stabilised.

The report further highlights triggers for rural recovery, which will also boost the FMCG sector, including easing of commodity inflation, higher crop realizations, ongoing government interventions and likely stimulus in the Union Budget.

Leading FMCG player Godrej Consumer Products Ltd (GCPL) also expects to deliver double-digit sales growth backed by low-single-digit growth in volume. The company is hopeful of a sequential improvement from high single-digit sales growth and mid-single-digit volume decline last quarter. The growth is broad-based led by double-digit sales growth in both home care and personal care, according to GCPL.

However, rural demand for FMCG products in the December quarter was not so encouraging amid rising inflation. Urban and premium categories maintained a steady pace of growth, observes Marico in its latest quarterly report.

Overall, the FMCG space recorded a modest demand growth in select categories buoyed by the festive season.

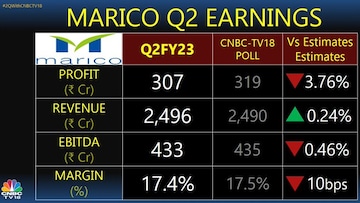

Another report by data analytics firm NielsenIQ said that the FMCG industry suffered an overall volume decline of 0.9 percent for the September-ended second quarter.

FMCG companies in 2022 resorted to double-digit price hikes due to inflationary pressure on margins. Many companies embraced the 'shrink-flation' practice as well. Shrinkflation means reducing the size or quantity of the product while keeping the price unchanged. The Russia-Ukraine war also resulted in a shortage of raw materials and disturbed the supply-chain mechanism.

Now, FMCG companies are hoping to recover the lost ground in 2023. Already, the sector is witnessing a modest recovery in margins and volumes. The current market scenario in the rural segment also looks promising now amid softening commodity prices.

(Edited by : Abhishek Jha)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: 28% of candidates contesting in fourth phase are 'crorepatis'

May 9, 2024 4:29 PM

Free poha-jalebi to movie ticket discounts: How cities struggling with 'urban apathy' are luring voters to polling booths

May 9, 2024 3:17 PM