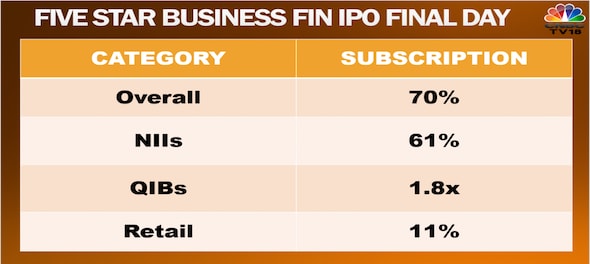

Five Star Business Finance — a Chennai-based financier — made a weak debut in the secondary market on Monday, as its shares debuted on BSE at Rs 450 apiece, a discount of 5.1 percent to the upper end of its IPO price range. On NSE, the stock is listed at Rs 468.8 apiece — a discount of 1.1 percent. The listing was in line with investors' response to its IPO, which concluded earlier this month with an overall booking of 70 percent.

The stock finished the listing day at Rs 489.5 apiece on BSE and Rs 490 apiece on NSE — a premium of around three percent.

The IPO, to raise up to Rs 1,960 crore, received bids for 2.1 crore shares as against the three crore shares on offer, according to exchange data. The public offer comprised an offer for sale (OFS) by existing shareholders — meaning the company would not get any proceeds from the issue.

Out of the total issue, 50 percent was reserved for qualified institutional buyers, 15 percent for high net worth individuals and the remaining 35 percent for retail investors.

Five Star Business Finance's debut was also in line with the trend in the grey market — or an unofficial market for unlisted securities — since its IPO.

| Date | Grey market premium/discount (in rupees) |

| Nov 21 | Discount |

| Nov 19 | Discount |

| Nov 18 | Discount |

| Nov 17 | Discount |

| Nov 16 | Discount |

| Nov 14 | Discount |

| Nov 12 | +/-5 |

| Nov 11 | +/-5 |

| Nov 10 | 10 |

| Nov 9 | 10 |

Five Star Business Finance's growth has slowed down to 15 percent post-COVID from pre-COVID expansion of 90-95 percent, its CMD, Lakshmipathy Deenadayalan, said in an interview to CNBC-TV18.

The company is adding 60-70 branches annually as against 40-50 pre-COVID, he said "Today we are adding close to 60-70 branches. So the ticket size, branch opening and more sourcing officers for Five Star will take its growth 2x better than the industry."

The company added 70 branches in the last 12 months, he said.

The IPO of Five Star Business Finance was open for subscription for from November 9 to November 11. Potential investors could bid for Five Star Business Finance shares in a price band of Rs 450-474 apiece in multiples of 31 under the IPO — which translates to Rs 13,950-14,694 per lot.

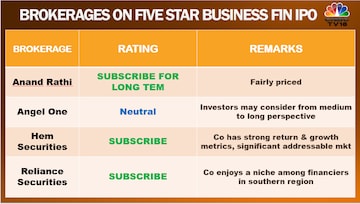

Analysts had generally positive views on the public offer.

First Published: Nov 21, 2022 10:07 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM