In the first fifteen days of April, there was a significant development in the Indian equity market as Foreign Institutional Investors (FIIs) turned buyers for the first time since November 2022 and this is the first fortnight buying since then.

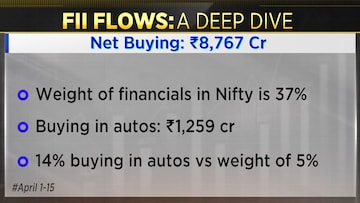

As per NSDL data, FIIs net bought Rs 8,767 crore in equities during this period, which indicates a positive sentiment toward Indian markets.

Let's take a deep dive into

FII flows during this period to understand where their interest lies.

The net buying of 8,767 crore was mainly driven by outsized buying in financials. FIIs bought financial stocks worth Rs 4,410 crore, which represents 50 percent of their total buying in the period.

The weight of financials in the Nifty index is 37 percent which shows that FIIs are overweight on this sector. Apart from financials, FIIs also showed interest in the automobile sector. They bought auto stocks worth Rs 1,259 crore, which represents 14 percent of their total buying. The weight of the auto sector in the Nifty index is only 5 percent, indicating that FIIs are overweight in this sector as well.

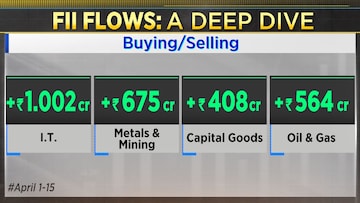

IT sector saw Rs 1,002 crore of buying, and metals and the mining sector saw net buying worth Rs 675 crore. There was buying in capital goods of around Rs 408 crore and the oil and gas sector, on the other hand, saw net selling worth Rs 564 crore.

Three stocks accounted for almost all of FII buying. Let's take a look at the FII buying activity in HDFC Bank, HDFC, and Tata Motors during the first fifteen days of April.

HDFC Bank saw a rally of 5.2 percent during this period, contributing 20 percent to Nifty's rally. The bank's delivery buying volume was 3.2 crore shares, with a delivery volume of Rs 5,305 crore. Roughly Rs 2,000-2,500 crore of FII buying would have contributed to this rally.

Similarly, HDFC saw a rally of 6.1 percent, contributing 18 percent to Nifty's rally during this period. The company's delivery buying volume was 1.7 crore shares, with a delivery volume of Rs 4,622 crore. Roughly Rs 2,500-2,700 crore of FII buying would have contributed to this rally.

Tata Motors saw a rally of 12 percent during this period, with a delivery buying volume of 4.76 crore shares and a delivery volume of Rs 2,134 crore. Roughly Rs 600-700 crore of FII buying would have contributed to this rally.

It is important to note that these calculations are based on the percentage of FII holdings in free float. It is possible that other factors such as domestic institutional investors, retail investors, and corporate buying could have also contributed to these rallies.

In conclusion, FIIs have been actively investing in the Indian stock market, with HDFC Bank, HDFC, and Tata Motors being some of the stocks that saw significant buying activity during the first fifteen days of April.