Even with the market trend looking uncertain given the range-bound movement in Nifty50, investors are looking for better opportunities to enter the market. A question that often plays at the back of an investor’s mind is — which stock should I buy right now? Among others, a gem that probably went unnoticed by many is Fiem Industries.

Analysts believe that the strong business prospects of Fiem could help the rear view mirror maker’s stock double in almost a year.

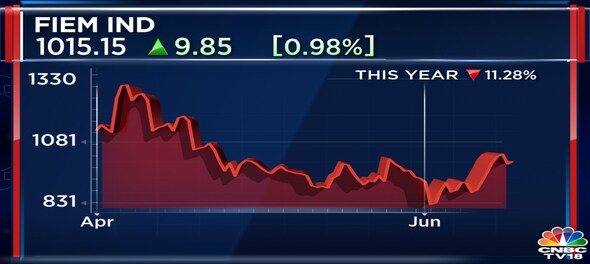

On June 4, the LED automotive lighting manufacturer's scrip ended 3.7 percent lower at Rs 1,005.30 on BSE. In the past year, the scrip has risen close to 50 percent while it has jumped about 118 percent in the past three years.

About the company

Fiem Industries manufactures automotive lighting, signalling equipment, rear view mirrors, sheet metal and plastic parts in India for two-, three- and four-wheelers. It has diversified its product portfolio by entering into LED luminaires for indoor and outdoor applications and integrated passenger information systems for railways and buses.

The company’s top clients in the two-wheeler space are Honda, TVS, Yamaha, Suzuki, Eicher Royal Enfield, Harley Davidson, and Mahindra, among others, and those in the four-wheeler space are Tata Marcopolo, Force Motors, Honda Siel, Hyundai, Daimler, and Mahindra Reva, among a few others.

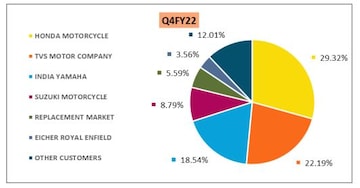

Top clientele contribution of Fiem (Source: Company's investor presentation)

Top clientele contribution of Fiem (Source: Company's investor presentation)In the fourth quarter of FY22, 96.64 percent of the company’s revenue came from the two-wheeler segment while 3.36 percent of it came from four-wheelers.

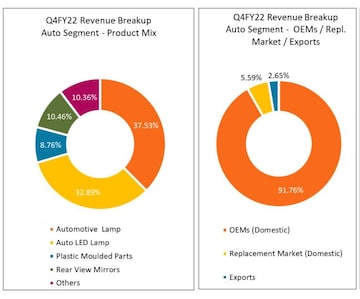

Fiem's revenue break up in Q4 of FY22 (Source: Company's Investor Presentation)

Fiem's revenue break up in Q4 of FY22 (Source: Company's Investor Presentation)What analysts say

The company has around 80 new projects under its belt and is working on three models of Hero MotoCorp as well. Fiem has ramped up its electric vehicle (EV) portfolio rather swiftly and is catering to well-known brands like Hero Electric, Okinawa, Ola, Revolt, Ampere, Tork, Polarity, and Bounce, said Monarch Networth Capital.

Fiem's customers in the EV space (Source: Company's investor presentation)

Fiem's customers in the EV space (Source: Company's investor presentation)Some analysts believe that with big names in its EV portfolio and a ramp-up in export orders, the growth runaway for Fiem remains long.

EVs contributed around Rs 400 million to Fiem’s total sales in FY22, and the company expects this to treble in FY23, highlighted Anubhav Rawat of Monarch Networth Capital in a research report.

Sales of electric cars (including fully electric and plug-in hybrids) doubled in 2021 to a new record of 6.6 million, with more now sold each week than in the whole of 2012, the International Energy Agency said in a release in May.

Also Read | A leather footwear maker's stock is up 4X in just one year. Should you be in this space now?

Despite strains along global supply chains, sales kept rising strongly into 2022, with 2 million electric cars sold worldwide in the first quarter, up by three-quarters from the same period a year earlier. The number of electric cars on the world’s roads by the end of 2021 was about 16.5 million, triple the amount in 2018, the agency pointed out.

With EVs being the future, Fiem is beating the blues with smart strategies of building a robust EV portfolio, better product mix and focussing on export-oriented sales in Yamaha, Harley and Piaggio, analysts believe.

Fiem's global OEM clients in the two-wheeler space (Source: Company's investor presentation)

Fiem's global OEM clients in the two-wheeler space (Source: Company's investor presentation)Fiem is trading at a valuation of 10 times forward its price to earnings multiple, according to Monarch Networth Capital which has retained its ‘buy’ rating on the stock with a hike in target price to Rs 1,580 from Rs 1,420. This implies a 57 percent upside from Friday's closing price.

A look at the firm's financial health

| Q4 FY22 | Q3 FY22 | Q4 FY21 | |

| Net profit (in Rs cr) | 32.00 | 24.04 | 25.48 |

| Revenue from operations (in Rs cr) | 489.51 | 388.84 | 421.22 |

Meanwhile, Kkunal Parar, vice-president of research at Choice Broking, sees a cup and handle formation on charts for Fiem, which is seen as a bullish signal extending an uptrend, and it is used to spot opportunities to go long.

Also Read | Are sneakers the new stocks? Here is all you need to know and the dos and don'ts of this new asset class

"From a one-year horizon, the stock faces strong resistance at Rs 1,375 level and sustenance above this level would drive the stock to touch Rs 1,965 which is almost double the current market price," said Parar. This means the stock has the potential to give over 95 percent returns in a span of one year.

He sees the first support for the stock at Rs 856 and the second at Rs 800.

Analysts have strongly expressed their optimism about the company's business prospects and the uptrend in the stock, and believe that the scrip has the potential to spawn stellar returns.

Industry outperformance and pricing power are also some factors that have made analysts go bullish on Fiem.

First Published: Jun 6, 2022 11:42 AM IST

Note To Readers

Disclaimer: The CNBCTV18.com editorial team does not engage in speculative or active trading in stock markets and follows its Code of Conduct on securities trading and investment. Any investor/ viewer is advised to carry out necessary diligence on their own or through a certified registered financial advisor for investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!