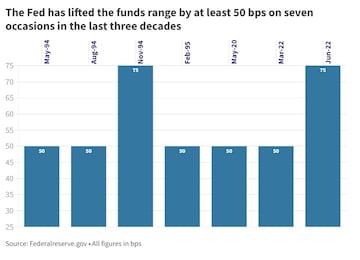

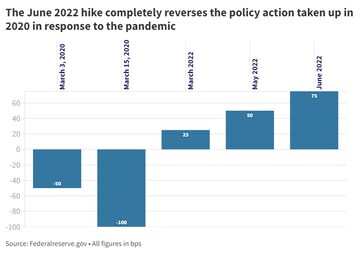

The Fed's latest hike in the COVID-era interest rates — two years into the pandemic — was the biggest since 1994. Even as the move was along expected lines, nervousness set in among investors globally on fears there might be steeper increases ahead, as central bankers scramble to tame four-decade high inflation and slowing growth.

Chairman Jerome Powell said the Fed is not trying to induce a recession. But it cut growth projections for the world’s largest economy staring at even worse unemployment ahead.

A look at history

This is not the first time the Fed has taken a big, bold step to achieve its goals — and there might be more ahead as many economists already think it is behind the curve amid fears of a possible recession.

Over the ages, policymakers at major central banks have remained focused on one ultimate goal: economic growth that is both sustainable and non-inflationary.

Cut to 2022

Just before the June 15, 2022 hike, investors were already nervous about a fresh 40-year high in US inflation debating how the Fed might react.

S&P 500 futures fell more than two percent ahead of the opening on Wall Street on Thursday, suggesting a big gap-down start ahead as investors return to US markets later in the day. Asian equities made a U-turn as the day progressed even though investors took the Fed move in stride initially.

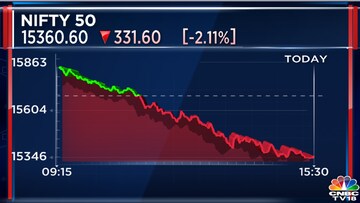

Indian equity benchmarks Sensex and Nifty50 made a violent U-turn hours after a gap-up start to settle at 13-month closing lows.

Across-the-board selling pulled the headline indices lower, with the Nifty Bank and Nifty Midcap 100 indices entering bear territory. A stock or index is said to be in the bear zone when it falls at least 20 percent from its recent peak.

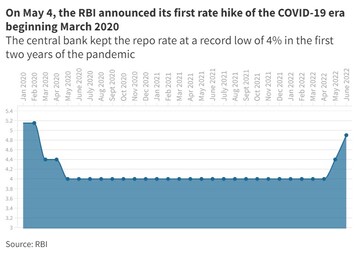

The Reserve Bank of India (RBI) has already hiked the repo rate — its key lending rate — by a total 90 bps in two tranches, the first being an out-of-cycle one hours before what would be the Fed's second increase of the COVID era.

The Nifty50 fell 2.3 percent on May 4 — its worst fall in two months — after the RBI announced the first rate increase since the onset of the pandemic in 2020.

The US central bank's intention is clear: Suck out excess liquidity from the system as fast as possible by avoiding causing a blow to the world's largest economy as much as possible.

The Fed's move to regulate the cost of money sends signals to its global counterparts — which then take decisions on their economies accordingly.

Here's a look at some of the wildest moves taken up by the Fed in history and how the world markets digested them:

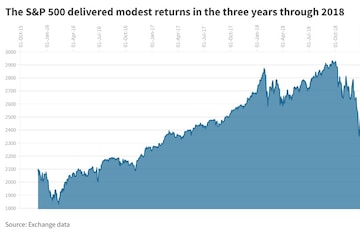

2015-18

The Janet Yellen era saw a total of nine hikes of 25 bps each spread over a period of three years. The piecemeal approach to money supply actually worked well for the markets.

The 500-strong US equity benchmark rose 18 percent during this period.

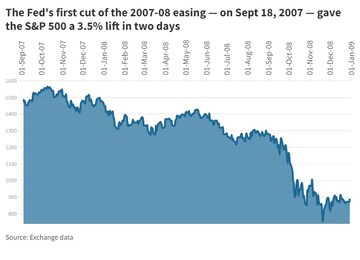

2008 financial crisis

Under Ben Bernanke, the Fed had an important situation to deal with: the 2008 financial crisis.

The US central bank had to take up rate cuts of 500 basis points in a matter of 15 months as the global financial system collapsed.

2004-05

Another policy tightening cycle, under the leadership of Alan Greenspan, saw the Fed taking up 17 rate hikes within a span of 24 months.

The first of the chain of hikes saw the S&P 500 fall 2.2 percent in a three-day losing streak.

This was the first increase, though of just 25 basis points, following a 30-month easing cycle.

1994

All the hikes taken up by the Fed since November 1994 have been of the 25-50 bps range — even the tightening cycles of 2004-06 and 2015-18.

The aim was simple: Cut the supply of money to align consumer prices with the strength in the economy and high levels of resource utilisation.

Once Wall Street absorbed the news, the S&P 500 lost 3.5 percent of its value in a period spread over five days. That's 130-odd points on the index gone in today's context.

In fact in all of 1994, the central bank lifted the interest rates by a total 250 bps (2.5 percentage points).

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM