US markets welcomed a surprisingly softer core inflation in October as it signalled a nearing end to the US Federal Reserve's interest rate hikes.

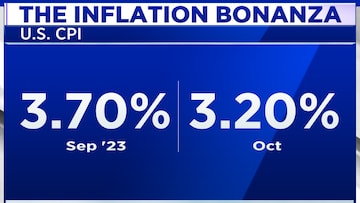

US Consumer Price Index (CPI) rose 3.2% in October from the same period last year, but showed no change compared to the previous month. The lower than anticipated readings were led by a 2.5% drop in energy prices, balanced out by a 0.3% increase in food prices.

The core CPI, excluding the volatile food and energy prices, also saw a lower than expected increase of 0.2% monthly and 4% annually. The annual rise marked the lowest since September 2021.

Dean Kim, Head-Global Research Product, William O'Neil + Co. told CNBC-TV18, “If we do see continued Producer Price Index (PPI) print coming in cooler than expected, definitely we should see changing character in terms of the way the Fed is thinking. I think that sentiment is kind of spreading towards other markets, in Asia.”

It must be noted that Fed Chair Jerome Powell has consistently emphasised that the central bank remains open to the possibility of raising rates again if deemed necessary.

“If it becomes appropriate to tighten policy further, we will not hesitate to do so,” Powell said in opening remarks of a panel discussion at an International Monetary Fund conference in Washington on November 9.

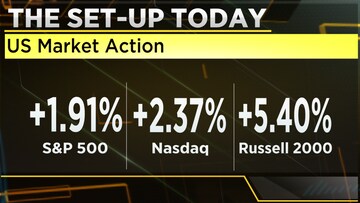

US equities have been on an uptrend in November with the S&P 500 gaining over 6% on hope the rate hike cycle has concluded and that there will be a rate cut next year. The index is on track for its most impressive month since October 2022.

Data compiled by Bloomberg over the past 22 years indicates that a 5% or more increase in the S&P 500 by mid-November meant positive moves for the rest of the year. Expanding the analysis to the last 50 years, this trend was positive in 26 out of 30 instances, with the declines in the four exceptions being 1% or less.

The positive inflation data also led to two-year treasury yields plunging over 20 basis points and the US dollar falling 1.5%.

A fund managers' survey by Bank of America Corp indicated that investors exhibited their

highest optimism in bonds since the global financial crisis, expressing strong confidence that interest rates will decrease in 2024.

Interest rates and bond yields move oppositely. Higher interest rates cause bond prices to drop and yields to rise, as older bonds with lower rates become less appealing than new, higher-rate bonds. Conversely, lower interest rates lead to higher bond prices and lower yields

Also Read

The increase in bond yields has played a pivotal role. Yields, which were below 4% in July, rose to nearly 5% in early November, a trend that prompted the Fed to take a more cautious approach.

Action in the Indian market

Markets in India also rallied on cues from global equities with the Nifty 50 opening at a one-month high of 19,651.40 on November 15. The last time it was above this level was on October 18, 2023, when the index had closed at 19,671.10.

The headline retail inflation rate in the country too eased to a five-month low in October, per government data released on November 13. Retail inflation was broadly in line with estimates at 4.87% in October compared to 5.2% in September.

While inflation has cooled for the second straight month and is well within the Reserve Bank of India's (RBI's) tolerance band of 2% to 6%, experts believe a repo rate cut still remains distant as there is uncertainty in food prices, particularly for kharif crops.

Food inflation, which rose 6.61% in October, contributes to nearly half of the overall consumer price basket in the country.

(with inputs from CNBC and Bloomberg)

For more details, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Nov 15, 2023 12:38 PM IST