Homegrown FMCG (fast-moving consumer goods) company Emami Ltd on Thursday posted a 60 percent year-on-year (YoY) decline in consolidated profit after tax (PAT) at Rs 142 crore in the January to March quarter as against Rs 354 crore in the same quarter a year ago. The company will buy shares worth up to Rs 186 crore, up to a price of Rs 450, it said in a regulatory filing.

Revenue from operations surged 8.8 percent at Rs 836 crore as compared to Rs 768.2 cr on-year in the corresponding quarter of last fiscal.

Emami reported an EBITDA (earnings before interest, tax, depreciation and amortisation) of Rs 223.6 crore for the quarter under review, which is up 19.5 percent over the previous year's quarter. Meanwhile, margins during the quarter came in at 26.8 percent versus 24.4 percent.

The FMCG industry witnessed a mixed demand environment in Q4FY23, as discretionary categories like personal care continued to remain muted on account of reduction of nonessential expenditure by rural consumers.

"Despite challenging demand scenario on account of high inflation, muted rural sentiments and unseasonal rains, we have delivered a resilient profit led growth in Q4FY23. After few quarters of ongoing pressure on input costs, we have been able to expand our Gross & EBIDTA Margins delivering 20 percent EBIDTA growth," said Harsha V Agarwal, Vice Chairman and Managing Director at Emami.

"Our strategic investments and Dermicool acquisition have performed well and contributed to this growth. We will continue to make significant investment behind our core brands, innovations, channel expansions and digital optimisations which are expected to contribute immensely to future growth," Agarwal said.

International business grew by 19 percent during the quarter despite high inflation, currency depreciation and geopolitical challenges in several key markets. The growth was mainly driven by strong performances in markets of MENA, CIS and Bangladesh.

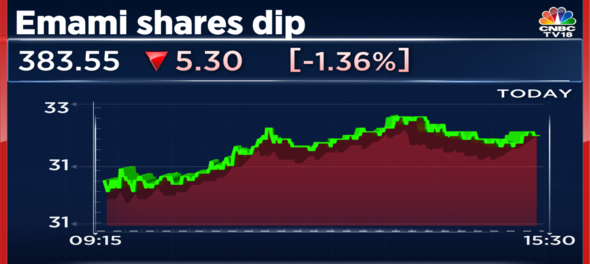

Ahead of the results, Emami stock closed 1.50 percent lower at Rs 383 apiece on the NSE. The shares fell 11 percent on a year-to-date basis, but it rose 5 percent in the last one month.

First Published: May 25, 2023 6:39 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!