Dharmaj Crop Guard — a Gujarat-based manufacturer of agro-chemicals — is set to launch an IPO on Monday to raise up to Rs 251 crore. The IPO will be a combination of fresh issuance of shares worth Rs 216 crore, and an offer for sale (OFS) worth Rs 35 crore by existing shareholders. Dharmaj Crop is engaged in making, distributing and marketing formulations such as insecticides, fungicides, herbicides, plant growth regulators, micro fertilisers and antibiotics to B2C and B2B customers.

Here are a few things to know about the Dharmaj Crop Guard IPO:

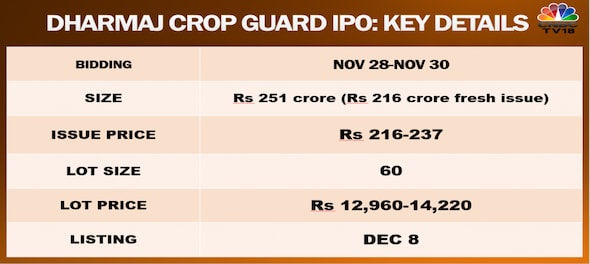

Important dates: Dharmaj Crop Guard shares will be available for bidding from 10 am to 5 pm for three days till December 30. Dharmaj Crop Guard will likely be listed on bourses BSE and NSE on December 8.

The basis of allotment of shares will likely be finalised on December 5.

Issue price: Potential investors will be able to bid for Dharmaj Crop Guard shares in a price band of Rs 216-237 under the IPO.

Lot size: Bidding will be available in multiples of 60 shares — translating to Rs 12,960-14,220 per lot.

Investor categories: At least 35 percent of the IPO is reserved for retail investors, 15 percent for non-institutional investors and up to 50 percent for qualified institutional investors (QIBs).

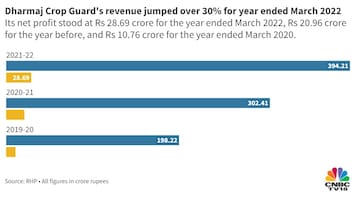

Financials: The company's profit margin — or the degree to which a business makes money — improved to 7.28 percent in the year ended March 2022, from 6.93 percent the previous year, according to the red herring prospectus.

Should you subscribe to Dharmaj Crop Guard's IPO?

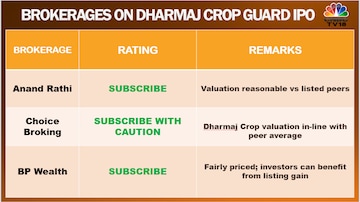

A number of analysts suggest subscribing to the issue.

According to Anand Rathi, the IPO values the company at a price-to-earnings multiple of 27.9 times its earnings for the year ended March 2022, which is reasonably priced.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM