Several investors are drooling over beaten-down Quick Service Restaurant (QSR) stocks. And market experts believe that some of them look like a decent investment bet right now.

Here's a look at how much QSR stocks have corrected in 2022 so far:

| QSR Companies | Year-To-Date correction | |

| 1 | Devyani International | 6% |

| 2 | Westlife Development | 16% |

| 3 | Sapphire Foods | 21% |

| 4 | Jubilant FoodWorks | 28% |

| 5 | Restaurant Brands Asia | 28% |

Abhay Agarwal, founder and fund manager at Piper Serica, a portfolio management service provider, believes that the primary reason for a sharp correction in the valuation of QSR stocks this year is that investors are not looking to pay a premium for unseen profits.

Market participants also believe the current COVID cases are still quite low to affect the operations of QSR companies. Further, the vaccination drive has almost ended, with people now going in for booster shots.

“The QSR industry is poised to do well, as the consumer sentiment is strong. I see very strong numbers for travel and airlines in the first and second quarters of this financial year. The number of visas and the long queues testify to the strong underlying demand. You may call it revenge spending, but leisure is returning after a gap of two years,” said Arun Malhotra, founding partner and portfolio manager, CapGrow Capital Advisors.

But does a decent correction in most QSR stocks offer an entry point to make good returns?

To this, Malhotra said, “All these are high P/E (Price to Earnings) stocks, and with markets falling due to various macro factors, high PE stocks tend to react more."

He said Jubilant and Westlife are at the forefront in expanding the distribution reach, while others have also expanded. "Restaurants Brands is around 22 percent CAGR (compound annual growth rate) in terms of store growth for three years. The majority of the QSR brands had expansion in gross margins by 150 to 200 bps as compared to pre-COVID levels. Jubilant has the best capital efficiency and should do well,” Malhotra said.

Agarwal noted that, as of now, most of the QSRs are either losing money or are breakeven at best, barring Jubilant FoodWorks. He also said Jubilant continues to be an outlier with a national presence, multi-cuisine model, and a very robust, profitable business.

The inflation hit

Agarwal believes that the rising food inflation will pressure the recently listed QSRs since they do not have the scale yet to bring down costs and protect operating margin. “While it is a promising space, premium valuations will keep investors on the sidelines in the current market scenario,” he said.

But Malhotra is quite positive about the industry and is of the view that the market opportunity is under-penetrated and that consumer preference for eating out quite frequently is fueling growth.

What could be key drivers for the stocks are higher distribution (through food aggregators like Zomato and Swiggy), higher asset turnover, and better unit store economics, said some experts.

Malhotra felt expansion into newer categories, brand extensions, and cost management would drive profitability.

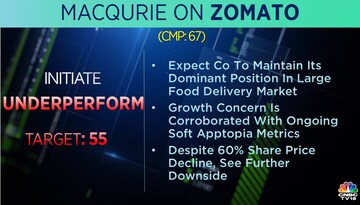

Meanwhile, Macquarie has initiated an ‘underperform’ rating on shares of Zomato but expects the restaurant aggregator to maintain its dominant position in the large food delivery market.

Here's what Macquarie said on Zomato

Here's what Macquarie said on ZomatoAccording to ICICI Securities, premium QSRs are better placed to implement price increases with relatively lower adverse effects of price elasticity.

The domestic brokerage firm said that Pizza Hut and KFC have attempted to maintain their slightly premium market positioning. It likes Sapphire Foods due to the company’s better demographic profile and also likes Jubilant at the current stock price as most of the concerns appear to be priced in.

ICICI Securities remains a long-term believer in Westlife Development, which runs McDonald’s restaurants in West and South India. However, the brokerage firm has no investment opinion on Devyani International but sees Restaurant Brands as a cyclical recovery play.

First Published: Jun 14, 2022 11:54 AM IST

Note To Readers

(Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Rahul Gandhi deserted Amethi due to fear of Smriti Irani': How BJP plans to puncture Congress' UP plan

May 3, 2024 1:12 PM

'Don't be scared, don't run away', PM Modi tells Rahul for not contesting from Amethi

May 3, 2024 1:06 PM