Dean Kim, Head-Global Research at investment firm William O'Neil + Co says the charts currently look good for the banking sector with a lot of good opportunities. However, given the current weakness in HDFC Bank, he advises being patient with it and keeping it on the sideline "until it recovers to the 200-day moving average.”

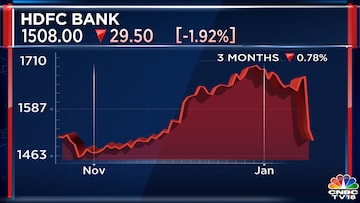

On January 17, nearly ₹1.1 lakh crore got wiped off of HDFC Bank's market capitalisation after the stock posted its biggest single-day fall in three years. The shares of the lender, which is the country's largest private bank by market cap, declined following the weaker than expected third quarter results. HDFC Bank stock is down close to 13% year to date.

Among other banks, Kim highlighted state banks like the Bank of Maharashtra and the

State Bank of India (SBI) that look good in terms of their technical setup.

He also listed consumer finance company Cholamandalam Investment and Finance that is looking strong on the technical charts.

Discussing the broader Indian equity markets, Kim said, “If we can find some support, should we break the 21-day moving average price support, it's around 70,000 in terms of Sensex, below that it’s a 50-day moving average. If we do see a bounce off the 50-day, that will be a great buying opportunity.”

For more details, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Jan 18, 2024 2:27 PM IST