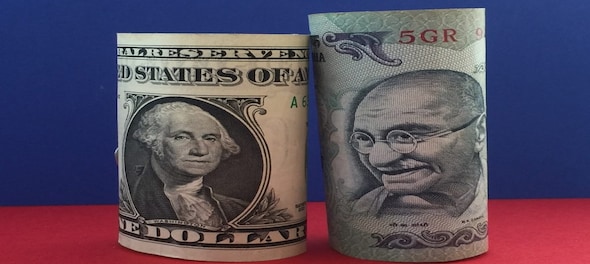

The rupee depreciated by 12 paise to 82.84 vs the US dollar on Friday. Earlier in the session, the Indian currency fell two paise from its previous close vs the greenback. The dollar index — which measures the American currency against the yen, the pound, the Canadian dollar, the Swedish krona, the Swiss franc and the euro — was last trading 0.1 percent lower at 102.2.

Crude oil benchmarks extended gains on Friday. At the last count Brent crude futures were trading 0.1 percent higher at $85.25 per barrel. WTI futures, too, were trading 0.2 percent higher at $81.73 per barrel.

"The enduring wave of Global Risk Aversion continues to exert strain on Asian currencies. The Indian rupee experienced a decline for the third consecutive session on Thursday, dropping to its lowest value in two-and-a-half months, mirroring widespread losses among its Asian counterparts. Furthermore, the pair was seen topping near the 82.70 mark a downward swing of 8-10 paise in 15-20 minutes of trade, probably RBI’s guided PSU’s buying was observed," said Amit Pabari of CR Forex.

"Overall, the rupee is expected to consolidate at 81.70-82.80, a range where the currency has spent maximum time since November. Thus, we expect that current ongoing risk-off sentiment is likely to remain short-lived as India’s Marco’s remain stronger than the rest of the world. As the IPO seasons have kicked in, the Rupee could get benefits due to FII Inflows in the coming days. Exporters should not hesitate to participate in around 82.70-90 levels. Importers should wait patiently to get a dip towards 82.20-30 levels," Pabari added.

First Published: Aug 4, 2023 10:22 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM