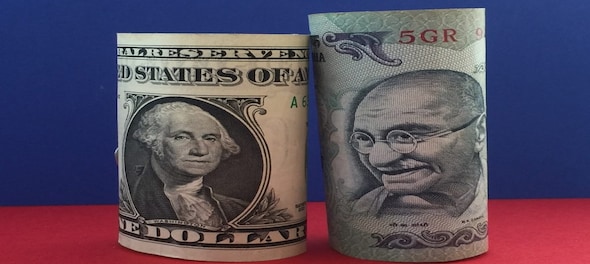

The rupee surged 22 paise from its previous close to a one-month high of 82.42 versus the US dollar on Thursday. On Wednesday, the Indian currency rose 25 paise at close against the greenback to post the biggest single-day gain in two months.

The dollar index — which measures the American currency against the yen, the pound, the Canadian dollar, the Swedish krona, the Swiss franc and the euro — was last trading marginally lower at 103.3.

Crude oil benchmarks eased on Thursday. At the last count Brent crude futures were trading marginally lower at $83.16 per barrel. WTI futures, too, were trading 0.11 percent lower at $78.82 per barrel.

"Post multiple attempts, the rupee yesterday finally broke the barriers to moving swiftly toward 82.68 levels. When Indian markets were off on 15-16th August and USDINR notched towards 83.46 levels in NDF, traders sold USDINR in the NDF market. On 17th August, when USDINR opened lower onshore amid RBI intervention, they might have bought USDINR. Hence, the market had a skewed position of the Sell-side in the NDF and the Buy-side in the onshore which can be termed as arbitrage," said Amit Pabari of CR Forex.

"Yesterday, RBI restricted banks from taking a fresh arbitrage position in NDF, which restricted sellers from selling more in NDF. Hence, they had to square off their onshore buying position by selling USD resulting in a sharp appreciation in the rupee. Secondly, FDI Investments that were lined up backed by fundraising from Adani, Reliance, and other corporates would have started hitting in thereby leading to an acceleration in the move.

All in all, with DXY resisting around 103.50 levels, appreciation in the Chinese Yuan and Japanese Yen, and domestic fundamentals remaining positive, the rupee is likely to have a soft landing towards 82.20-82.00 levels in the near term," Pabari added.

First Published: Aug 24, 2023 9:24 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Gonda Lok Sabha election: BJP's Kirti Vardhan Singh takes on Beni Prasad Verma's granddaughter Shreya

May 19, 2024 10:19 PM

Faizabad Lok Sabha election: Can Ayodhya Ram Temple strengthen BJP's stronghold here?

May 19, 2024 10:16 PM

Amethi Lok Sabha election: Can BJP's Smriti Irani retain the Congress bastion she won in 2019?

May 19, 2024 10:12 PM

Rae Bareli Lok Sabha Election: Can Rahul hold on to this Gandhi family bastion?

May 19, 2024 10:09 PM