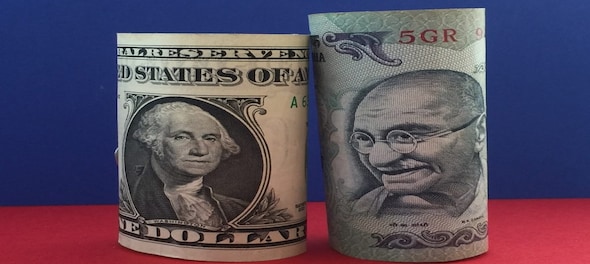

The Indian rupee gained two paise from its previous close to 83.02 versus the US dollar on Wednesday. The currency settled at 83.04 against the greenback on Tuesday.

The dollar index — which measures the American currency against the yen, the pound, the Canadian dollar, the Swedish krona, the Swiss franc and the euro — was last trading marginally lower at 104.7.

The US eco data suggested central bank need not change rates any time soon, Fed officials have said. US 10-year yield rose to 4.26 percent as investors asses prospects of rate hikes.

Crude oil benchmarks gained on Wednesday. At the last count Brent crude futures were trading 0.13 percent higher at $90.17 per barrel. WTI futures, too, were trading 0.14 percent higher at $86.8 per barrel.

"The rupee crossing the 83 mark isn't new. However, what remains key is the Reserve Bank of India gearing up to step in. In the past, when the Rupee reached these levels, the RBI took action to safeguard its value by offloading the reserves by about $8 – 10 billion. Not to forget, that the RBI has substantial reserves, with over 600 billion dollars at its disposal. So, they've got the firepower to protect the Rupee when needed. The message was quite clear last time when it disallowed the rupee to weaken in the face of inflationary pressure," said Amit Pabari of CR Forex.

"The chances of USD-INR breaking above 83.25 are merely 10-15 percent. However, initial hours of trade will be crucial to gauge the direction and check for the RBI’s intervention. If RBI intervenes, the pair shall likely move towards 82.90 levels. Following a proper hedging policy in line with risk management would be favourable rather than gauging the rupee momentum when there is uncertainty," he added.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Gonda Lok Sabha election: BJP's Kirti Vardhan Singh takes on Beni Prasad Verma's granddaughter Shreya

May 19, 2024 10:19 PM

Faizabad Lok Sabha election: Can Ayodhya Ram Temple strengthen BJP's stronghold here?

May 19, 2024 10:16 PM

Amethi Lok Sabha election: Can BJP's Smriti Irani retain the Congress bastion she won in 2019?

May 19, 2024 10:12 PM

Rae Bareli Lok Sabha Election: Can Rahul hold on to this Gandhi family bastion?

May 19, 2024 10:09 PM