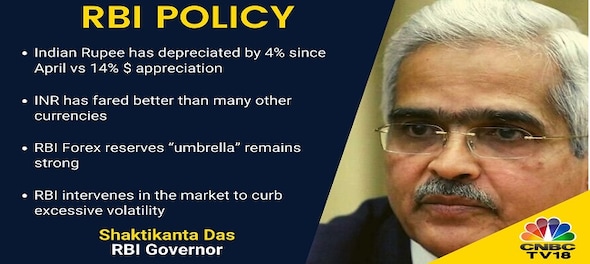

Reserve Bank of India (RBI) governor Shaktikanta Das on Friday said that the central bank had intervened in the forex market to curb excessive volatility and their umbrella on forex reserves remains strong.

Das said that the Indian rupee had fared better than many other currencies. It depreciated in a very orderly manner vs other currencies. So far, the rupee has dropped by 7.4 percent in FY23.

"Rupee is a freely floating currency, and the exchange rate is market-determined. Our actions have helped encourage investor confidence. The aspect of the adequacy of forex reserves is always kept in mind," he said while making monetary policy announcements.

"Our actions will be carefully calibrated to incoming data without being constrained by any textbook approach to policymaking," he added.

India’s forex reserves now stand at $537.5 billion as of September 23.

According to Das, about 67 percent of the decline in reserve during the current FY is due to valuation changes from the appreciating dollar to higher US bond yields.

He added that the central bank would step in (and buy or sell dollars) only if there was heightened volatility.

The rise in India’s imports has been rising much faster than exports, taking the country’s current account deficit – the net outflow of foreign exchange from the country – to its highest in 15 quarters.

Meanwhile, RBI has raised the benchmark lending rate by 50 basis points to 5.90 percent in a bid to check inflation. With the latest hike, the repo rate or the short-term lending rate at which banks borrow from the central bank, is now close to 6 percent.

This is the fourth consecutive rate hike after a 40 basis points increase in May, and 50 basis points hike each in June and August. Overall, RBI has raised benchmark rate by 1.90 percent since May this year.

Catch latest RBI policy updates with CNBCTV18.com's blog

First Published: Sept 30, 2022 11:03 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM

Election Commission grants shifting of 7 polling stations in Kullu, Mandi, Shimla and Kinnaur

May 5, 2024 6:50 PM