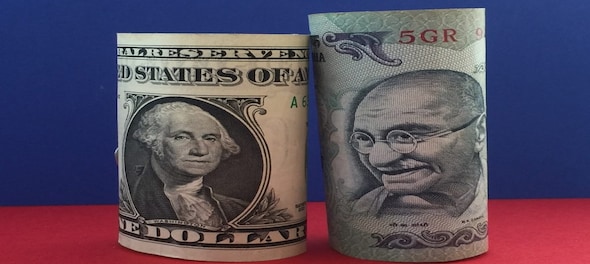

Rupee rose nine paise to start the session at 81.24 vs dollar amid fall in the value of greenback against a basket of six peers. Crude oil benchmarks also fell on Monday. The dollar index — which measures the American currency against the yen, the pound, the Canadian dollar, the Swedish krona, the Swiss franc and the euro — dropped to below 102. At the last count, the index was trading 0.3 percent lower at 101.6.

Crude oil prices slipped on Monday. Brent crude futures were trading 0.5 percent lower at $84.8 per barrel at the last count. WTI futures, too, were trading 0.8 percent lower at $79.5 per barrel at the last count.

"The real market action or biggest event will be due on Wednesday when the Bank of Japan will deliver its monetary policy. Hawkish BoJ leads to a rise in Japan’s Yield and a lower differential with the US, leading to a stronger Yen and weaker USD and thus helping EM currencies to appreciate," explained Amit Pabari, Managing Director at CR Forex.

"On the positive side, weaker US data, yields and US Dollar index, then lower oil prices, easing trade deficit, stronger Asian Currencies - especially Yen and Yuan and FDI flows. On the negative side, FII’s persistent outflow this month, RBI’s intervention to build up FX reserves and returning of Oil Marketing Companies (OMC) to hedge their imports could weigh on the rupee," he added.

"Considering the given positives and negatives, one can say that bias-ness for the pair remains bearish with a potential short-term range of 80.80 to 81.80. Whereas, on the upside, resistance is located around 81.50 to 81.80, where exporters who missed to book or have new exposures will look to sell and could be a cap for the pair," Pabari said.

Indian equity benchmarks BSE Sensex and NSE Nifty50 are expected to open higher on Monday tracing positive global cues.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM