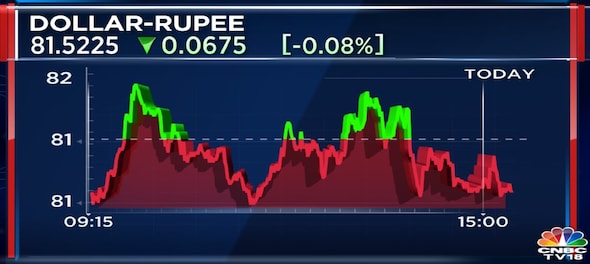

Rupee gained by seven paise from its previous close on Friday to 81.52 vs the US dollar. Earlier in the session, the rupee rose 11 paise to 81.48 vs dollar amid steadiness in value of greenback against a basket of six peers. Global crude oil benchmarks moved higher putting pressure on the currency. The dollar index — which measures the American currency against the yen, the pound, the Canadian dollar, the Swedish krona, the Swiss franc and the euro — was trading flat at 101.7.

Crude oil prices moved higher on Friday extending gains from previous session amid strong economic data and optimism of reopening of Chinese economy. Brent crude futures were trading 0.4 percent higher at $87.8 per barrel at the last count. WTI futures, too, were trading 0.4 percent higher at $81.3 per barrel at the last count.

"The rupee has been on a Zig-Zag move over the past many days as importers are rushing to cover dollars ahead of a slew of economic data and events along with RBI’s intervention near 81-81.20; whereas exporters and inflows are hitting critical resistance levels of 81.70-81.90 zone," said Amit Pabari of CR Forex.

"Broadly, the rupee is expected to trade further into a consolidation range of 81.20 to 81.90 over the next 2-3 sessions before any big trigger helps it to break the same. Chances are high for the downside break with the potential to move towards 80.50 to 80 over the medium term. However, RBI might intervene regularly to curb sudden appreciation," Pabari added.

Indian equity benchmarks BSE Sensex and NSE Nifty50 ended at a three-month low on Friday.

First Published: Jan 27, 2023 9:09 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM