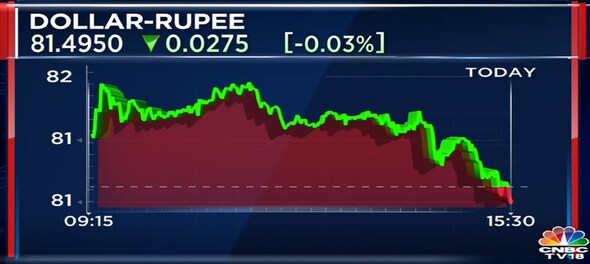

Rupee, on Monday, ended two paise higher from its previous close at 81.50. Earlier in the session, the currency depreciated by 12 paise from its previous close on Monday to open at 81.64 vs the US dollar amid steadiness in value of greenback against a basket of six peers. Global crude oil benchmarks moved lower supporting the currency. The dollar index — which measures the American currency against the yen, the pound, the Canadian dollar, the Swedish krona, the Swiss franc and the euro — was trading 0.1 percent lower at 101.6.

Crude oil prices moved lower on Monday. Brent crude futures were trading 0.2 percent lower at $86.2 per barrel at the last count. WTI futures, too, were trading 0.2 percent lower at $79.5 per barrel at the last count.

"No major announcements are expected in the budget that could dramatically affect the rupee," said Amit Pabari of CR Forex, adding that, "A hawkish Fed with a 25-bps hike shall make DXY jump towards 103 to 104 levels and USD-INR towards 81.80-82.20 levels. Whereas, a less hawkish Fed with a 25-bps hike could keep DXY flat and so the USD-INR."

"Overall, considering expectations from the events globally and domestically, the rupee is likely to consolidate between a broad range of 80.80 to 82.20 levels. That makes 80.80-81.20 a buying zone for importers and between 81.80-82.20 a selling zone for exporters for the near to medium term," Pabari added.

Indian equity benchmarks BSE Sensex and NSE Nifty50 ended higher on Monday. The trade remained choppy throughout the session.

First Published: Jan 30, 2023 10:28 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM