The latest economic data were published last week, indicating that the US economy remains on solid footing. Gold prices held up relatively well – but can it last?

Recent US economic data shows general health

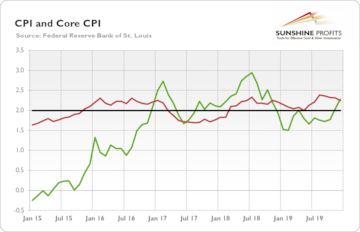

Last week was full of economic reports. Let’s analyse them. First, the CPI rose 0.2 percent in December, slightly below expectations and the 0.3-percent increase in November. But as the chart below shows, the CPI (and the core CPI as well) rose 2.3 percent over the whole of 2019, which was the largest advance since the 3.0-percent rise in 2011. Yet inflation is still quite low by historical standards.

Annual percentage change in the US CPI (green line) and the core CPI (red line) from January 2015 to December 2019.

The wholesale inflation measured by the PPI rose just 1.3 percent last year, half as much as it did in 2018. It means that inflationary pressures are limited in the US economy. Moreover, the PCEPI, the Fed’s preferred inflation gauge, rose just 1.5 percent over the twelve months ending in November. The muted inflation implies that it is unlikely the Fed will hike the federal funds rate anytime soon. Although gold likes high and accelerating inflation, the US central bank keeping interest rates on hold is positive for the gold prices.

Second, the Fed’s Beige Book shows that the US economic activity continued to expand ‘modestly’ over the last six weeks of 2019. What is important is that the expectations of the near-term outlook ‘remained modestly favourable’. However, the Beige Book also reports job cuts in manufacturing, transportation and energy sectors, which is in line with the last report on the nonfarm payrolls.

Third, when it comes to the industrial sector, industrial production fell 0.3 percent in December, the third decline in the past four months. In the whole last year, the output fell 1 percent. It shows that the sector is still weak, hurt by the trade wars, but excluding the motor vehicle sector, factory output rose 0.5 percent, so we could perhaps see revival in the near future.

Fourth, retail sales increased 0.3 percent in December and 5.8 percent in the whole of 2019, slightly above the average for the past 30 years. It shows that consumer spending remains solid.

Last but not least, the privately owned housing starts in December came at a seasonally adjusted annual rate of 1,608,000, which was 17 percent above November and 41 percent above December 2018. The new residential construction reached a 13-year high, but it was mainly because of the warmer-than-usual temperatures. The change in building permits, which are less sensitive to weather, was weaker.

Implications for gold

Leaving the industrial production aside, last week’s economic reports were generally positive, showing that the US economy is still solid. It keeps looking like a goldilocks economy: Inflation is low, the pace of economic growth is moderate, the retail sales and the housing market are solid. Theoretically, gold should suffer in the face of positive economic news.

Indeed, as we have seen last week not only good economic reports but also two important developments for the global economy. First, the potentially dangerous conflict between the US and Iran de-escalated as quickly as it appeared. Second, the US and China signed the ‘phase one’ accord in their trade dispute. In consequence, the US stock market reached a new all-time record.

So, one could reasonably expect the bearish trend in the gold market. However, the yellow metal held steady, which is a solid performance given the headwinds that occurred last week. Why was gold so resilient? One explanation might be that investors worry about the long-term consequences of the recent ultra-easy monetary policy. After all, even central bankers worry! Dallas Fed President Robert Kaplan said last week that the recent Fed’s actions were contributing to elevated risk asset valuations as they have given investors green light to buy risky assets and this is a concern. Anyway, gold’s resilience in the face of headwinds might be a bullish sign.

Arkadiusz Sieroń is an Assistant Professor at University of Wrocław, a certified investment adviser and a long-time precious metals market enthusiast.

First Published: Jan 22, 2020 1:24 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Dharwad Lok Sabha Election 2024: BJP's Pralhad Joshi eyes fourth term from this Karnataka seat

May 7, 2024 9:33 AM

Gulbarga Lok Sabha election: Mallikarjun Kharge's son-in-law Radhakrishna faces sitting BJP MP Umesh Jadhav

May 7, 2024 9:00 AM