2023 can best be described as year of conflicts among countries, erratic weather and high interest rates. As per a Bank of America report, there were 300 rate hikes across global central banks from 2021 through 2023. But 2024 could see around 152 rate cuts and that would be the major theme for commodities.

Apart from the current geopolitics and China recovery hope, the impact of higher interest rates and the currency factor would also be in play as would be the green energy transition and the move away from fossil fuels.

Crude oil prices are headed for an annual decline - the first one since 2020. The prices did trade in a range of $70 per barrel to $96 per barrel. 2023 was all about OPEC plus cutting output and record high US production and then the COP28 transitioning from fossil fuels put some more pressure towards the end of the year, bringing down the 24 outlook with Citi least bullish with $75 a barrel of a price forecast, while Morgan Stanley, JP Morgan, Goldman Sachs projected crude within $80 per barrel to $93 a barrel.

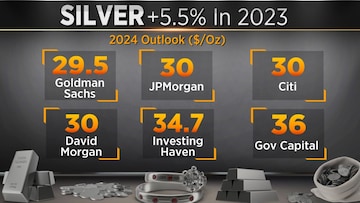

Silver has globally hit multi month highs but hit an all-time high in the Indian markets for the year.

There are concerns about global deficits, strong demand and the rupee depreciation. Prices gained more than 5% with projections of higher highs in 2024.

Gold prices hit an all-time high in 2023 in US, in China, in Japan, in Korea, Taiwan, Australia and India and various other countries. The view on the next year is of higher highs up to $2,200 an ounce.

In terms of industrial metals there were contradicting fundamentals of supply disruptions and weak demand on the other side. 2024 could support the green energy buying and improving Chinese demand.

Nickel was the underperformer in the pack with 43% decline in 2023. 2024 forecasts are put higher through and through in this metal.

Zinc is the second worst performing LME metal this year slumping 16% as weak construction activity has hit the metal’s main use in galvanising of steel. But zinc is also expected to do well with forecasts anywhere between $2150 per tonne to $2650 a tonne.

Aluminium prices are also closing 2023 with a negative of 2.5%. As supplies idle capacity in Europe and China comes back online. For 2024 it's a higher target set by global exports. And then it's copper where the prices are headed for a marginal 2.5% gain in 2023 after a very volatile year, as the Street believes that with new projects coming online, it could be a state of demand.

The demand will start to pick up and that would be supportive. So 2024 price outlook ranges from $8300 per tonne to $10,000 a tonne.

Finally it's about iron ore - the last on the list, which is a best performer in metals with 23% of gains and with expectation that going forward in 2024, you could be looking at prices averaging at around $100 a tonne.

For more, watch the accompanying video