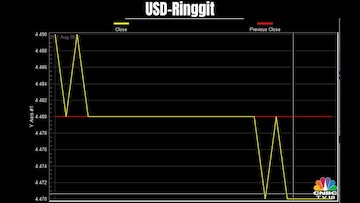

Malaysian ringgit ebbed to the lowest levels in five years against the dollar last week. As a result, it is set to pull down palm oil prices further aiding India’s fight against inflation. The Malaysian currency plunged to 4.4810 against the greenback on Friday — a level last seen in January 2017. On Thursday, ringgit fell to 4.47 vs the US dollar — last seen during the Asian financial crisis in early 1998.

The weakness in the ringgit has followed the wider currency and foreign fund outflow trends ($1.82 billion in Malaysia’s case until August 18) in other major economies, including India, as the US Federal Reserve pushed interest rates higher to tame inflation amid the ongoing geopolitical tensions.

Why it matters?

A weaker ringgit makes Malaysian palm oil more attractive for buyers, reflected in Malaysia's benchmark palm oil futures, which rose for a third straight session on Tuesday, August 23.

Overall, edible oil prices have been volatile this year, facing a double whammy of sorts. First, the war in Ukraine pushed sunflower prices higher on short supply, and secondly, the world’s largest palm oil producer Indonesia imposed a ban on palm oil exports in April (subsequently clarifying the policy prohibited only refined palm oil exports, and later lifted it in May).

Among edible oils, palm oil accounts for around 40 percent of the global supply with Indonesia and Malaysia accounting for more than three-fourths of it.

After a strong rally owing to the above factors, palm oil prices fell to multi-month lows amid rising production in the face of low export demand. In fact, both Indonesia and Malaysia have either reduced or removed duties to promote palm oil exports to help local producers now.

The Malay government has kept its export tax for crude palm oil at 8 percent, ensuring that Malaysian palm oil prices are about the same level as Indonesia's. The latter has also suspended its export levy until October end and eased regulations for local palm producers.

The big picture and India’s “imported” inflation

India is among the top two consumers along with China of edible oils. Palm oil accounts for more than half of India’s edible oil import basket. A sharp jump in prices of commodities used to produce edible oils owing to the fallout of global supply disruptions pushed India’s retail inflation to an eight-year high of 7.79 percent, much above the 4 (+/-2) percent tolerance zone of the Reserve Bank of India.

The country benefitted from the low average year-on-year inflation in vegetable oils between 2014 and 2020 at around -5.79 percent, which spiked to more than 33 percent in the last two years, as per an article in The Centre For Policy Research

The headline retail inflation, however, has eased to 6.7 percent in July 2022 on the back of a decline in food inflation.

"The declining global prices of edible oils and the government's measures to reduce domestic prices of these commodities have had a profound impact on tempering India's retail food inflation," the finance ministry said in its Monthly Economic Review released on Friday.

Experts suggest that in the short-term prices may remain bearish but the overall long-term outlook remains firm.

“With strength in the Ringgit and easing labour issues in Malaysia, palm oil production is expected to rise this year. Indonesia also extended the export levy waiver until October 31. Global edible oil prices corrected from record highs in the last two months. However, the higher energy prices and demand from the EU and China are supporting prices at lower levels. Looking to the fundamentals, edible oil prices will remain soft for next one to two months but increased demand during the festival season could continue to support prices,” Manoj Kumar Jain, Director-Head of Commodity Research, Prithvi Finmart told CNBC-TV18.com.

Ajay Kedia, Founder and Director, Kedia Advisory said that prices may consolidate around current levels.

"The prices in September are expected to be slightly weaker due to lower crude oil prices, easing supply chain situation, especially vis-a-vis soybean and edible oil stocks from the Black Sea area. But prices may consolidate as Q3 coincides with the festive season and it is usually a strong season," Kedia told CNBC-TV18.com.

First Published: Aug 25, 2022 11:12 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM