Gold prices in India fell on the Multi Commodity Exchange (MCX) Tuesday, while silver prices also traded lower.

At 10:45 am, gold futures for October delivery fell 0.16 percent to Rs 47,510 per 10 grams as against the previous close of Rs 47,584 and the opening price of Rs 47,515 on the MCX. Silver futures traded 0.16 percent lower at Rs 62,825 per kg. The prices opened at Rs 62,792 as compared to the previous close of Rs 62,927 per kg.

“The gold prices are likely to remain sideways to positive amid a weaker US dollar. The focus will now shift to Jackson Hole, Wyoming, symposium. The trend remains bullish hence buy on drops can be deployed,” said Ajay Kedia, Director, Kedia Advisory.

“On MCX, gold may find support at Rs 47,100 and resistance at Rs 47,850. Support for silver is seen at Rs 62,100 and resistance at Rs 63,600,” Kedia added.

International gold prices hovered above the key psychological level of $1,800 on Tuesday, as the looming threat from the Delta coronavirus variant fanned expectations that the US Federal Reserve might delay dialling back its pandemic-era stimulus, said a Reuters report.

Spot gold eased 0.2 percent to $1,801.65 per ounce, having jumped about 1.4 percent in the previous session. US gold futures were down 0.1 percent at $1,804.10.

The dollar index was steady after falling about 0.6 percent on Monday.

“Gold has started trading above its key psychological level of $1,800/oz basis dollar weakness and on the hope that Federal reserve may take step back on tapering timeline. Technically, bulls have some near-term advantage above $1,800 level and must form a new base around these levels,” said Sandeep Matta, Founder, TRADEIT Investment Advisor.

Market participants will be eyeing on an upcoming economic symposium which could become the new catalyst for gold to surge

“Gold on MCX is also finding its major support on Rs 47,000 and trading with short term bullish technical advantage. The outlook is positive for a precious metal particularly due to weak dollar and increasing cases of delta variant globally,” Matta added.

He advises traders to follow key levels on both sides and accumulate gold on every dip.

Key level for Gold October contract – Rs 47,453

Buy Zone Above – Rs 47,460 for the target of Rs 47,756 - Rs 47,900

Sell Zone Below – Rs 47,450 for the target of Rs 47,300 – Rs 47,050

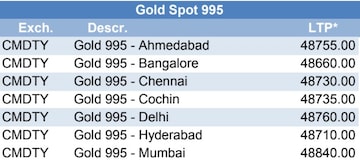

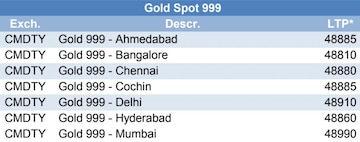

Here are gold rates across major cities:

Here are silver rates across major cities:

(Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.)

First Published: Aug 24, 2021 10:55 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | What does a low voter turnout indicate for NDA and I.N.D.I.A Bloc

Apr 29, 2024 5:48 AM

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM