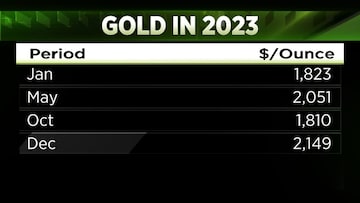

Gold prices soared to unprecedented highs, breaching the $2,100 per ounce mark globally on Monday. At 0353 GMT, spot gold registered a 0.7% increase, reaching $2,085.76 per ounce, while earlier in the session, it peaked at an all-time high of $2,111.39. Simultaneously, US gold futures rose nearly 1% to $2,107.60. This surge, a staggering 3% rise during early trading on Monday, notably surpassed the prior peak set on August 7, 2020, before receding from those substantial gains.

In India, amidst the peak wedding season,

gold prices have hit an all-time high of ₹63,500 per 10 grams.

Catalysts driving the surge

Analysts attribute this surge to Federal Reserve Chair Jerome Powell's recent remarks, which buoyed traders' confidence in the potential for an early next year cut in US interest rates. Lower interest rates inherently diminish the opportunity cost of holding non-interest-bearing assets like gold.

"Traders were more convinced that we're currently at the peak of the US interest rates and therefore that the path forward from here is more likely to be down rather than up," Tim Waterer, chief market analyst at KCM Trade was quoted as saying in a Reuters report.

Powell's dovish stance during his recent speech, mentioning balanced risks of under- and over-tightening, led to a decline in the dollar index and 10-year Treasury yields, elevating gold's allure to holders of other currencies.

It is understood that when the dollar index and Treasury yields decrease, it means that the value of the US dollar against other currencies diminishes, and the returns on US government bonds decline. This scenario tends to make gold more appealing to holders of currencies other than the US dollar.

Market sentiments

Market sentiment remains strong due to recent data indicating cooling inflationary pressures and gradual labour market easing. Fed Governor Christopher Waller's hint at a possible rate cut in case of sustained inflation decline further solidified this stance, as per Reuters.

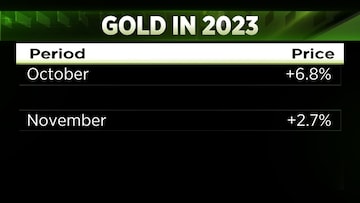

Investor focus now turns to the US non-farm payrolls data due on Friday, anticipated to influence the trajectory of US interest rates. Gold has surged approximately 16% from its early October lows, fueled initially by haven buying following geopolitical tensions and subsequently, by mounting expectations of US rate cuts,

Bloomberg report said.Avdhut Bagkar, Technical and Derivatives Analyst at StoxBox, highlighted, "Markets bet that the Federal Reserve could begin cutting interest rates as soon as March 2024, even as central bank officials remained cautious."

Rahul Kalantri, VP Commodities at Mehta Equities, also attributed the surge to speculation surrounding the Fed reaching the pinnacle of its rate hike cycle.

Demand and outlook

Veer Mishra, Co-Founder of Plus, emphasised the upcoming wedding season's potential to further boost

gold prices in India, citing the metal's significance as a popular wedding gift and a reliable investment option amid growing economic stability.

Factors anticipated to influence gold prices during the impending wedding season include heightened jewellery demand, increased investment interest amid inflation concerns, and the anticipated continued growth of the Indian economy. It's crucial to note that gold prices are influenced not only by domestic factors but also by global economic conditions and the trends observed in other precious metals, reflecting the web of factors contributing to gold's soaring value.

Investment strategy

According to Chintan Mehta, CEO of Abans Holdings, it's prudent for investors to exercise caution when

considering investing in gold at this point. He suggests a strategy that involves partially booking profits and maintaining a lighter position in the market.

Mehta highlights the significant rally gold has undergone recently. This surge, he believes, reflects the changing stance of the Federal Reserve committee members and accounts for the ongoing shift in the interest rate cycle, along with easing geopolitical tensions.

In terms of risk and reward, Mehta advises investors to adopt a cautious approach by maintaining a lighter position in their gold investments. He suggests waiting for potential lower levels to re-enter the market, aiming to capitalise on the next bullish cycle.

According to

Vikram Dhawan, Head of Commodities and Fund Manager at Nippon India Mutual Fund, "Gold is significantly undervalued even at current levels. Moreover, the cost of gold production has risen significantly. A decade ago, the average or incremental cost of production was around $1000-1200 per tonne. My sense is that it has now increased to somewhere around $1600-1800 per tonne. We are not too far away from that if you look at it in percentage terms. So, all these factors will push the equilibrium price much higher than what we have seen in the past few decades."

(Edited by : Amrita)

First Published: Dec 4, 2023 12:22 PM IST