Gold prices breached Rs 61,000 levels for the first time in India just before the RBI monetary policy meeting on April 6, largely led by economic uncertainties around the world. India is the second largest consumer of gold despite moderately low per capita consumption currently. While demand for the yellow metal could face threats in the short term from declining household savings rate and agricultural wages, income could be the key long-term driver of demand

But it is affected by a variety of other factors, including RBI policy measures.

But, despite high interest rates, gold prices in India have surged nearly 20 percent in the past year and now hovering above Rs 60,000 per 10 grams currently.

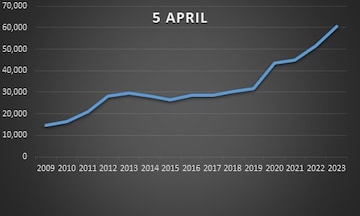

Gold prices since 2009

On the policy front, RBI is expected to raise its repo rate by 25 basis points on Thursday to tame red-hot inflation across the nation but keep its stance accommodative, a CNBC-TV18 poll showed.

Usually, the yellow metal is considered a safe haven asset during tight financial environment. That is in-line with expectations of bullion traders who now predict precious metals including silver prices to further rise taking cues from a slowing US economy. The Federal Reserve, however is expected to raise rates once more before pausing this year.

"We believe the market will be well supported not only by ETF inflows once Fed fund rates have peaked but by a stronger 'Wealth' effect from the East as the dollar depreciates into year-end on yield compression and EM GDP grows strongly on China re-opening effects,” Goldman Sachs said in the note.

Gold is traditionally considered a hedge against inflation and economic challenges but higher interest rates lower the appeal for the non-yielding bullion.

Also, precious metals continue to benefit from hedge funds ditching their bearish bets, with prices holding solid support levels and producing upward momentum, new bullish bets are entering the marketplace, according to the latest trade data from the Commodity Futures Trading Commission.

“The combination of continued and strong central bank demand, which helped support prices in 2022 when yields and the dollar surged higher, and renewed investment demand via ETFs following months of net selling is likely to be the main engine that support sustainable higher gold prices,” says Ole Hansen, Head of Commodity Strategy at Saxo Bank.

“Hedge funds with their non-sticky and directional driven positioning will continue to add an additional layer of strength during rallies, but also weakness during periods of correction.”

Global Gold Trigger

In the US, gold crossed the key $2,000 level as the dollar and bond yields fell after data showed private job openings in February dropped to a near two-year low, while manufacturing activity slowed for the fifth consecutive month.

Money managers increased their speculative gross long positions in Comex gold futures by 5,440 contracts to 130,530. In the meantime, short positions dropped by 12,491 contracts to 31,370, CFTC data showed.

“Gold briefly traded above $2,000 while reaching a fresh record against the Australian dollar and close to a record against the euro. Whether the price will reach a record against the dollar as well during the coming quarter will, apart from movements in yields and the dollar, depend on Fed funds reaching their terminal rate, an event that on three previous occasions since 2001 helped trigger a strong rally in the months and quarters that followed,” said Hansen of Saxo Bank.

The spike in gold prices comes after oil prices rose this week led by a surprise output cut by OPEC+. Investors bet on the safe-haven asset at a time when global markets await policy decisions from several central banks in the coming weeks. It is interesting to note that there is a 57 percent probability of the Fed pausing in May, according to money market traders.

Since the start of the banking crisis two weeks ago with the collapse of two major regional US banks, about 24 tonnes of gold has flowed into the world's biggest gold ETF, SPDR Gold Shares.

(Source: GoldPriceIndia.com)

The Silver Lining

Likewise, silver rate has shot up in the domestic market with a strong support placed at Rs 70,000 per kg levels.

Indeed, silver imports have been historically high in the past few months. Industrial demand for silver has driven imports to a record high of 1,173 metric tonnes in the past year, according to the data from Ahmedabad Air Cargo Complex.

With gold touching record breaking numbers, retail demand for the white metal has gone up with everyday jwelleries and accessories stealing the market from the yellow metal.

(Source: GoldPriceIndia.com)

Despite the removal of tax benefits from gold funds and gold ETFs by the government, demand for gold remains attractive. Bets on Gold ETFs also have been rising mostly due to its transparency, convenience, safety and they being a cost-effective investment option compared with buying physical gold.

Historical trend shows, gold prices usually surge on the back of global uncertainties from time-to-time.

The Russia-Ukraine war, US banking collapse have been major drivers of the price rise and central banks’ next move will possibly decide the yellow metals direction in the very near-term.

(Edited by : Anshul)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM