Equities and gold are negatively correlated. The reason behind this is that when equities underperform due to slower growth or high inflation, flows get diverted towards risk-off assets such as gold. Traditionally, gold is considered a safe-haven asset as it provides higher returns over the long term due to sustained demand and lower output.

ALSO READ

It’s a non-yielding asset but also a traditional investment, which over a longer period provides positive returns. Further, an intermarket analysis suggests that when equities top out and start to correct, gold, along with other commodities with a lag effect, moves higher to make a top.

Current global scenario

The geopolitical uncertainty caused by Russia’s invasion of Ukraine has boosted risk-sensitive sentiments to push spot gold to nearly $1,940 per ounce. Geopolitical tensions or war-like situations have benefitted gold in the past.

Besides, Russia is the world's third largest producer of gold, which makes the overall situation more critical as western sanctions may impact the Russian supply of the yellow metal, making it more expensive. Gold prices are up around four percent so far this year and further upside can be seen due to the following fundamental factors.

World central banks are moving towards policy normalisation and interest rate hikes, which will impact the flow moving towards emerging market equities. Overall, a higher discount rate is surely not good for equities from a valuation point of view.

Equities are topping out especially in emerging markets

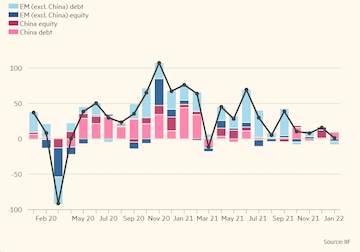

Global capital flows into equities were greater in 2021 than the combined flows of the previous 19 years. However, US inflation at a record high along with steadier growth has pressurised the Fed to go for steeper rate hikes. History suggests that when the US has its own inflation problem to deal with, it turns out to be bad for emerging markets. With the exception of China, emerging market stocks and bonds suffered as much as $7.7 billion in outflows of foreign money in January. This suggests a shift of capital from an emerging market to any other market, and equities/bonds to underperforming commodities such as gold.

Global capital flows into equities were greater in 2021 than the combined flows of the previous 19 years. However, US inflation at a record high along with steadier growth has pressurised the Fed to go for steeper rate hikes. History suggests that when the US has its own inflation problem to deal with, it turns out to be bad for emerging markets. With the exception of China, emerging market stocks and bonds suffered as much as $7.7 billion in outflows of foreign money in January. This suggests a shift of capital from an emerging market to any other market, and equities/bonds to underperforming commodities such as gold.Apart from falling equities, do gold fundamentals support the bullish rally?

Gold prices could take cues from the following factors:

Russia- Ukraine crisis

In times of geopolitical uncertainty, the price of gold tends to move higher along with other commodities. Catch latest on Russia-Ukraine war with CNBCTV18's live blog

Hawkish Fed rate hike but negative real rates

Gold usually exhibits a high correlation with inverted real yields, i.e. the lower the real yields, the higher the gold price. However, during periods of rate hikes, gold’s negative correlation with long-term real rates tends to break down. Rate hikes lead to fears of a growth slowdown and recession, and, therefore, boost demand for safe-haven assets. As everyone knows how much behind the curve the Fed is, with inflation at 7.5 percent and the funds rate at 0-0.25 percent. By the time Fed lifts its rates, the economy will have already topped out and started to shrink.

Pent-up demand from top gold consumers

According to the World Gold Council CEO, the demand for gold was mainly driven by central bank buying during the fourth quarter of 2021 and a recovery in jewellery consumption, mainly in India and China. In India, demand for gold jewellery grew 93 percent to a six-year high in 2021. In China, demand for gold coins and bars rose by 44 percent.

Technical view: A bullish formation

The symmetrical triangle breakout at $1850 on the weekly chart of the international gold prices suggests further bullishness towards $1960 to $1992 levels. The recent bottom of $1880 and $1860 will be crucial levels to watch as immediate supports.

Outlook

In a nutshell, the weighing scale goes in favour of the bullish gold prices as a hawkish Fed and rate hikes will lead to an outflow from the riskier equities. The hikes could also increase the chances of the economy topping out. Further, rising concerns about supply amid the Russia-Ukraine crisis, or higher demand from top consumers such as China and India could also support the prices. Overall, the yellow metal is likely to shine over other asset classes in the time to come.

Strategy

Russia-Ukraine tensions have taken the yellow metal’s price above $1,930 per ounce. In the coming days, if the tensions ease, we will certainly see some cooling off in gold prices to near $1,870. However, that should be considered an opportunity to buy as the overall indicators are giving bullish signals. On the upside, if the price breaks $1,960, we could soon see levels of $2,070.

--Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article are his own.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive | Full text of the PM interview: Modi's agenda for the next 5 years

Apr 29, 2024 10:28 PM

PM Modi says he’s going forward with a positive attitude as a response to personal attacks

Apr 29, 2024 10:08 PM