The global crude oil market is on tenterhooks as tensions in the Middle East continue to surge. Peter McGuire, CEO of XM Australia pointed to the potential for crude oil prices to skyrocket to the $100 per barrel mark. The key driver of this anxiety is the ongoing uncertainty surrounding the Israel-Hamas conflict and the looming threat of an escalation, that could further inflame an already volatile oil market.

“It has got the potential to be up higher, I mean it has just been dynamic. So, possibly $95/bbl, maybe $100/bbl in this rally,” said McGuire in an interview with CNBC-TV18.

Latest developments in the Israel-Hamas conflict:

The United States has issued a caution that the

Israel-Palestinian militant group Hamas conflict has the potential to escalate and encompass the broader Middle East, drawing the oil-abundant area into a state of conflict.

“There is a risk of an escalation of this conflict, the opening of a second front in the north, and of course of Iran’s involvement,” Sullivan told CBS’s Face The Nation.

Sullivan expressed his primary apprehension over the prospect of Hizballah, headquartered in Lebanon, launching attacks on Israel from the northern front.

In recent days, there have been minor clashes between Hizballah, a group backed by Iran, and Israeli military forces. Iranian Foreign Minister Hossein Amirabdollahian cautioned Israel against encroaching upon the

Gaza Strip, emphasizing that Tehran would not stay passive in such a scenario.

The Middle East is responsible for roughly 30% of the global oil production, and if the conflict escalates, it may push oil prices beyond $100 per barrel, adding to the challenges of controlling inflation at a time when the world is grappling with rising prices.

How have oil prices been over the last couple of weeks:

On October 16,

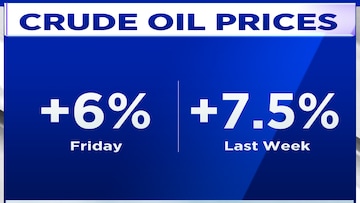

Brent crude futures marked a new recent high at $91.20 before slightly pulling back to $90.84, in the wake of a near 6% increase on Friday, October 13.

US West Texas Intermediate crude futures settled at $87.7 per barrel on Friday, marking its most substantial daily gain since April 3. International benchmark Brent crude futures, scheduled for December delivery also surged by $4.89, or 5.7%, reaching $90.89 per barrel on the same day.

Last week, WTI crude registered a gain of over 4%, marking its most substantial weekly increase since September 1.

The Israel-Hamas conflict has raised concerns about potential impacts on regional energy production. It's important to note that the Middle East also represents over one-third of the world's seaborne trade.

(with input from agencies)

For more details, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Oct 16, 2023 2:05 PM IST