Benchmark indices ended the week on a positive note. With the conclusion of the Reserve Bank of India's policy decision, the key Indian indices came off their day's high.

On Friday, Nifty50 closed 0.1 percent higher at 17397.5 while Sensex ended at 58387.93, up 0.2 percent.

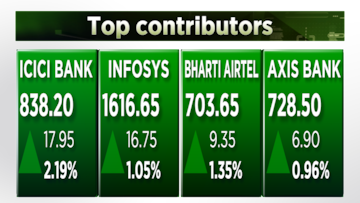

Today's gains were driven by shares of information technology and financials.

The indices had risen slightly after the monetary policy outcome.

The Reserve Bank of India's Monetary Policy Committee (MPC) decided to increase the repo rate by 50 basis points to 5.40 percent in its bi-monthly policy meeting, Governor Shaktikanta Das said on Friday.

The central bank's rate hike, the third in the current financial year, came in a bid to tame the inflationary pressure and protect against further rupee depreciation.

India’s real gross domestic product (GDP) growth projection for the financial year 2022-23 is retained at 7.2 percent whereas the RBI has also retained its retail inflation forecast for the current financial year at 6.7 percent.

Naveen Kulkarni, Chief Investment Officer, Axis Securities, said, “With core inflation continuing to hover well above the upper tolerance limit, the RBI increased the repo rate by 50 bps, broadly in line with market expectations”.

While the domestic inflationary pressures seem to be easing out gradually, he quickly warned that the geopolitical tensions, volatility in global financial markets, and emerging risk of the global recession continue to remain key.

Thus, the RBI has retained its inflation estimates for FY23, mildly tweaking Q2 and Q3 estimates, expecting relief only from Q4 onwards. It has also retained its growth estimates at 7.2 percent for FY23, he explained.

Stock Reaction

Shares of SpiceJet soared 9 percent on Friday after the airline and EaseMyTrip announced to enter general sales agreement. Another positive news that did the rounds was that SpiceJet is in talks with potential investors for a likely stake sale in the airline.

A slightly lower-than-estimated net profit by Mahindra and Mahindra Ltd for the June quarter dragged the tractor maker's stock lower. M&M's scrip closed 2 percent lower.

Global Markets

Investors looked forward to the US jobs data that will give another clue to the health of the world's largest economy as warning signs flashed in bond markets and oil traded around its lowest level since the start of the war in Ukraine.

MSCI's broadest index of Asia-Pacific shares outside Japan was up 1 percent whereas key European indices traded in the red.

S&P futures were flat, hinting at a lukewarm start for US equities later today.

(With inputs from agencies)

First Published: Aug 5, 2022 3:55 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM