The current market rally has been met with celebration as all-time highs are achieved. However, it's important to note that the rapid surge in many stocks has outpaced their underlying fundamentals. As a result, several stocks have recently received downgrades, indicating a more cautious outlook.

Let's begin with Cholamandalam Finance, an exceptional company that recently saw a "neutral" rating from Citi following its downgraded assessment. Although the stock has risen by 56 percent year-to-date and 48 percent since the March lows, Citi believes that the stock has reached its peak multiples, trading at 4.5 times FY25 price to book and close to 21 times EPS. This reasoning has led to the downgrade of Cholamandalam Finance.

Moving on to

One 97 Communications, Macquarie was the first to upgrade the stock when it was priced at around Rs 400 levels. However, Macquarie has now become the first to downgrade it to a "neutral" rating at Rs 850.

The downgrade is attributed to lingering business risks and uncertainties, particularly due to Ant Financial's intention to sell a 25 percent stake in the company.

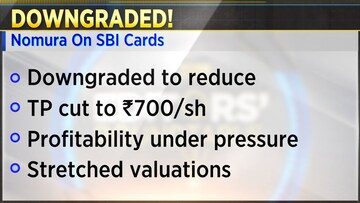

SBI Cards, another stock in focus, has observed an 8 percent increase year-to-date, with a significant 16 percent rally in the past three months since the March lows.

Nomura has downgraded the stock to "reduce" and significantly revised its target price to Rs 700, down from the earlier target of Rs 1,030. Nomura expresses concerns over profitability and stretched valuations, leaving no room for errors.

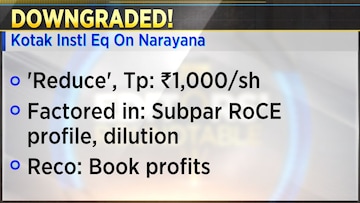

Narayana Hrudayalaya, a stock that has performed well, recording a 30 percent increase year-to-date, has been downgraded to "reduce" by Kotak Instl Eq. With their earlier target price of Rs 1,000, they now advise clients to sell into the recent rally following the substantial one-year surge.

While there are cautionary downgrades, one stock that has experienced a consensus upgrade in recent weeks is

InterGlobe Aviation. The stock has seen a remarkable 48 percent rally from its lows, attracting multiple positive updates.

Morgan Stanley, for instance, has upgraded the stock for the second time in the last 10 days, raising the target price to Rs 3,321. UBS also anticipates strong Q1 results, which will establish a robust foundation for FY25, leading them to increase the target price to Rs 3,300.

Additionally, Kotak Institutional Equities has included IndiGo in its model large-cap portfolio with a target price of Rs 3,000, while Citi raised its target price to Rs 2,900.

However, it's important to note that such sales can only occur after the quarterly results are announced. This potential overhang notwithstanding, IndiGo has received significant upgrades across the board, highlighting its positive prospects.

As we navigate the current market landscape with its highs and cautious sentiments, it is essential to remain informed about both the downgrades and upgrades affecting various stocks.

First Published: Jun 30, 2023 8:54 PM IST