Two prominent brokerages, Nomura and UBS, hold contrasting views on the cement sector, with Nomura adopting a positive outlook while UBS remains cautious.

Nomura believes there are strong near-term drivers which outweigh structural challenges. Their analysis reveals that the

cement sector has historically experienced its highest volume growth during pre-election years over the past four election cycles. Nomura's forecast predicts a compounded annual growth rate (CAGR) of 5 percent for cement demand from FY24 to FY26, surpassing the 3.8 percent achieved during FY13 to FY22.

The brokerage maintains its positive stance in the short term, citing moderated input costs as a contributing factor. They anticipate a 30 percent year-on-year improvement in EBITDA per tonne for FY24. However, they acknowledge that the potential for return on capital employed (RoCE) expansion is limited due to the large under utilised asset base and a flat cost structure.

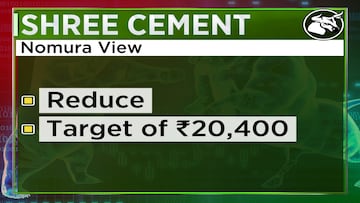

Dalmia Bharat is Nomura's top pick in the sector, as they believe the company has the potential to become a pan-India player in the near future. On the other hand, they have given

Shree Cement a reduce rating, citing the company's diminishing cost advantage and its shift away from its traditional base in north India.

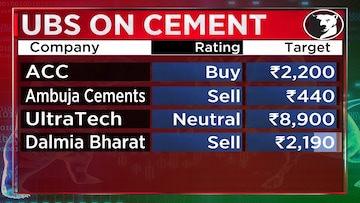

In contrast, UBS holds a negative view on the cement sector, primarily due to increasing competition and high valuations. The brokerage suggests that any significant surge in stock prices may present an opportunity for profit-taking.

UBS anticipates a slowdown in

cement demand following the general elections in May 2024, as well as an excess of capacity additions compared to medium-term demand. They expect players in the sector to rely on pricing strategies to foster growth or defend their market share. Furthermore, UBS sees limited potential for value-accretive merger and acquisition (M&A) activities.

Despite their cautious stance, UBS maintains a positive outlook on

ACC and retains a buy rating. However, in contrast to Nomura, they suggest selling Dalmia Bharat, and they have also lowered their ratings on other companies in the sector.