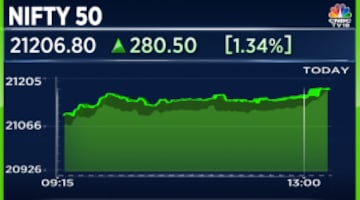

The equity markets popped Thursday on dovish Fed. The US Federal Reserve held its key interest rate steady for the third straight time and set the table for multiple cuts to come next year and beyond. The Nifty 50 index shot up around 300 points to touch an all-time high of 21,210.90, and the Sensex surged over 1,000 points to hit a record high of 70,589.

The Bank Nifty index also shot up by 1.50% or 700 points to hit 47,943.60 on Thursday. Meanwhile, the market capitalisation of all BSE listed companies jumped by ₹4 lakh crore to ₹355.18 lakh crore.

Among individual stocks, SAIL climbed 8% to hit a 52-week high of ₹112.25 after the stock was moved out of the F&O ban list. Shares of NBCC also surged 6% after the construction company secured work orders worth ₹1,500 crore.

Sectoral indices including the Nifty Realty index soared 3.48%, Nifty IT advanced 3.45%, led by Mhpasis, Coforge and Persistent Systems. Nifty Bank, Financial Services, and oil & gas were also trading over 1% higher.

What analysts say

"We can see a further new high in the market if the bond yields and the crude prices remain at the same levels for the entire month. Large caps seem better placed at current levels in terms of overall valuations. Based on a favourable macroeconomic picture compared to other emerging markets, flows may shift towards large caps, especially large-cap banks, in the near term," said Pranav Haridasan, MD and CEO at Axis Securities.

Dipan Mehta of Elixir Equities said: "Tactically, you are better off buying into financials or IT stocks for this point of time. You could expect outperformance within those two segments over the next three to four months, maybe six months as well."

Mehta said that PSU still remains a great long term story because reforms over there and increased government spending and a lot of other factors PE re-rating certainly benefit these companies.

He added, "And in May 2024, if BJP does come back to power, then this rally will certainly gather even more momentum. But I think next few months, you could see a bit of a pause in this particular segment or sector and I am more hopeful of some of the laggards because if you want the index to move up to higher levels 15-20% over the next year or so and if the laggards like IT, like financials which have to take on the burden and take on the leadership position and take the indices higher."

What's fuelling today's rally?

1) Dovish Fed

Indian equity markets witnessed strong buying interest on Thursday after the US Federal Reserve flagged the end of its tightening cycle and struck a dovish tone for the year ahead.

A near unanimous 17 of 19 Fed officials project that the policy rate will be lower by the end of 2024, with the median projection showing the rate falling three-quarters of a percentage point from the current 5.25%-5.50% range. No officials see rates higher by the end of next year.

The Fed kept interest rates steady for the third meeting in a row, as was widely expected.

The US central bank acknowledged that inflation has eased and implied that the rate tightening cycle might be over. Its dot plot, which forecasts the potential path forward for monetary policy, hinted that lower borrowing costs could be in the cards in 2024.

US stocks

US stocks soared to a sharply higher close on Wednesday following Fed's early holiday present this year. All three major US stock indexes jumped to fresh closing highs for 2023.

The Dow Jones notched a record closing high, confirming the blue-chip industrial average has been in a bull market since September 30, 2022, by common definition. The index jumped by 512.3 points, or 1.4%, to 37,090.24.

The S&P 500 rallied 63.39 points, or 1.37%, at 4,707.09 and the Nasdaq Composite gained 200.57 points, or 1.38%, at 14,733.96.

US dollar drops

The dollar reversed its gains against a basket of world currencies, dropping after the central bank projected interest rate cuts in 2024. The US dollar index tumbled to 102.89, down 0.83% on the day, and the lowest since November 30.

When the index falls, US investors see an opportunity for higher returns in India, which leads to an inflow of Foreign Institutional Investment (FII).

10-year Treasury yield

Treasury yields dropped on Wednesday, with the yield on the 10-year hitting its lowest level since August after the FOMC policy outcome.

The yield on the 10-year Treasury was last down 16 basis points at 4.048%, earlier hitting a low of 4.015%. The last time the 10-year traded below the 4% level was August 10, when it hit 3.957%. The 2-year Treasury yield dropped 25 basis points to 4.485%.

FIIs buying

In India, foreign portfolio investors (FPIs) bought shares worth ₹4,710.86 crore on a net basis during the previous session while domestic institutional investors (DIIs) sold shares worth ₹958.49 crore.

So far in December, FIIs bought shares worth ₹33,959 crore.

First Published: Dec 14, 2023 2:58 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Election Commission grants shifting of 7 polling stations in Kullu, Mandi, Shimla and Kinnaur

May 5, 2024 6:50 PM

Tents, fans, ambulances – Karnataka gears up for voting on May 7 amid soaring heat

May 5, 2024 6:19 PM

Karnataka Congress files complaint against BJP’s JP Nadda and others over alleged MCC violation

May 5, 2024 3:20 PM

PM Modi to contest from Varanasi, to file nomination papers on May 14

May 5, 2024 2:49 PM