Bikaji Foods International — a Rajasthan-based FMCG company — made a decent debut in the secondary market on Wednesday, with the stock commanding a premium of 7-8 percent over its IPO price. On BSE, Bikaji Foods shares listed at Rs 321.2 apiece — a premium of 7.1 percent.

The stock began its journey on NSE at Rs 322.8 apiece — 7.6 percent above Rs 300, the upper end of its issue price band.

The listing was in line with the trend in the grey market — an unofficial market for unlisted securities — over the past few days.

| Date | Grey market premium (in rupees) |

| Nov 16 | 25 |

| Nov 14 | 25 |

| Nov 12 | 35 |

| Nov 11 | 35 |

| Nov 10 | 35 |

| Nov 9 | 35 |

| Nov 8 | 15 |

| Nov 7 | 15 |

| Nov 6 | 25 |

| Nov 5 | 25 |

| Nov 4 | 40 |

| Nov 3 | 75 |

| Nov 2 | 75 |

| Source: IPO Watch |

The stock finished the listing day at Rs 317.5 apiece on BSE and Rs 322.7 apiece on NSE.

The snack maker's IPO, worth up to Rs 881 crore, concluded earlier this month with an overall subscription of 26.7 times the shares on offer. By the end of the final day of the bidding process, the IPO received bids for 55 crore shares against the 2.1 crore shares on offer, with a robust response from qualified institutional buyers, according to provisional exchange data.

The IPO was available for three trading days till November 4. The initial share sale was entirely an offer for sale by existing shareholders — which means the company will not receive any proceeds from the issue.

Potential investors could bid for Bikaji Foods International shares in a price band of Rs 285-300 apiece in multiples of 50 under the IPO — which translates to Rs 14,250-15,000 per lot.

Bikaji Foods International's management is confident of the company's strong growth prospects.

In the last 3-4 years, Bikaji Foods has been logging a compounded annual growth rate (CAGR) of 20-22 percent, its CFO, Rishabh Jain, told CNBC-TV18.

"It's a big industry. So this industry is close to Rs 1.5 lakh crore and we are just Rs 600 crore; it's a strong growth prospect, which we look at in the coming decade. We have done expansion across all parts of India in the last two years. So we are very much hopeful that we will do a same business, same growth in the coming years also. It's a big opportunity for us," he said.

The company is looking at a double-digit margin in the six-month period ending March 2023, he said.

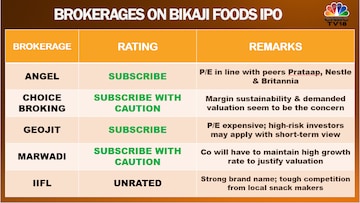

A number of analysts had recommended subscribing to the IPO.

The stock of Global Health (Medanta) listed on bourses at a premium of about 19 percent on the same day:

First Published: Nov 16, 2022 10:01 AM IST