Berger Paints’ shares extended gains on Friday, a day after the paint maker posted its financial results for the April to June 2022 quarter, in which the company registered a massive jump in profit and revenue.

The paint maker’s shares jumped 2.7 percent in early deals and were trading 0.7 percent higher at Rs 671.80 at 10:24 am. Though Berger Paints stock has made investors nearly 17 percent richer in the past month, in 2022 so far (year-to-date), it has erased more than 13 percent of investors’ wealth as against the benchmark Sensex which has declined a percent during the period.

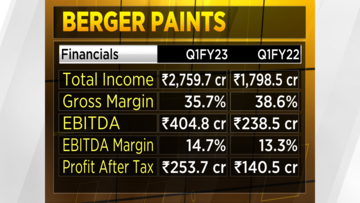

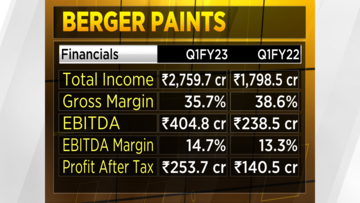

The firm on Thursday posted an 80.60 percent increase in consolidated net profit to Rs 253.71 crore for the first quarter ended June 30, 2022. In the same quarter a year ago, the firm had posted a net profit of Rs 140.48 crore.

Berger Paints’ revenue from operations for the first quarter of the fiscal witnessed a strong growth at Rs 2,759.7 crore - a more than 53 percent increase from the income of Rs 1,798.5 crore that the firm registered in the corresponding quarter last year. This comes as the company told CNBC-TV18 that decorative volume growth stood at 35 percent.

The firm’s earnings before interest, taxes, depreciation, and amortisation (EBIDTA) came in at Rs 404.8 crore, nearly a 70 percent jump when compared with the previous quarter.

The EBITDA margin — the amount by which a business's operating revenue exceeds its costs — went up by 140 bps YoY to 14.7 percent in the three-month period. The gross margin for the quarter under review, however, slipped to 35.7 percent from 38.6 percent in the same quarter last year.

Dipan Mehta, Director, Elixir Equities is of the view that though Asian Paints is what drives the sentiment for the paint industry, Berger Paints cannot be much far behind.

“It is an aggressive company and somewhat similar mould as Asian Paints with a large proportion of decorative paints within its portfolio. I think it's just a matter of time before this company also should start to rally,” he told CNBC-TV18.

Mehta suggested that investors must keep in mind that Asian Paints, Berger Paints and Kansai Nerolac Paints are all on the expensive side and whether such volumes will be sustained going forward for these companies when they see emerging competition needs to be seen.

He expects earnings to be more or less in line with expectations with a 15-20 percent growth. He was more concerned about the price to earnings multiple, which still remains pretty much high despite all the changes taking place within the industry.

According to independent market expert Kush Ghodasara, paint stocks have been on the run since crude prices have stabilised, which has boosted the margins of paint markers.

He expects a boost in the topline of paint makers in the current quarter as people generally repaint their houses at the time of Navaratri and Diwali. "With declining crude prices, I believe margins should further improve which will have a positive effect on the bottom line too," he told CNBCTV18.com and recommended investors to buy Berger Paints shares.

Note To Readers

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 20% voter turnout recorded by 11 am

Apr 26, 2024 9:11 AM