Analysts at global brokerage CITI expects up to 23 percent downside to Bata India Ltd shares in the next 12 months as they believe the stock is overvalued.

CITI has initiated coverage on the country’s largest footwear retailer with a ‘sell’ rating and target price of Rs 1,310 per share implying potential downside of up to 23 percent.

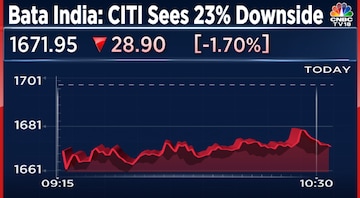

Bata India shares dropped by 3 percent to touch a low of Rs 1,648.90 apiece on BSE on Wednesday after a bearish call by analysts.

Bata India is the largest footwear retailer in terms of revenue and number of retail stores in India.

CITI noted that as per its estimates, despite being the market leader, Bata India has lost market share led by subdued performance (zero percent volume compounded annual growth rate (CAGR) over the past decade).

Despite multiple initiatives and reach expansion in the last 2-3 years, revenue CAGR over FY19-23 was only 4 percent - the lowest among top 4 listed footwear players in India, CITI observed.

The financial services firm also noted that although valuation at 45x FY25 P/E at consensus estimate appears inexpensive or attractive, reverse DCF at current market price implies 17.2 percent revenue CAGR over FY26-36E against 10.8 percent revenue CAGR pre-COVID in the past decade.

Reverse DCF is a valuation technique that works backwards from the current share price to estimate the implied growth rate of future cash flows.

A higher reverse DCF than the growth rate in the past period implies that the current stock price is too optimistic and does not reflect the realistic growth prospects of the company and the stock is overvalued.

Bata India had reported a 10 percent fall in net profit to Rs 107.8 crore for the April-June quarter of FY24 compared to Rs 119.3 crore in Q1FY23.

Revenue from operations grew by 2 percent year-on-year to Rs 958.1 crore in Q1 of FY24.

The company last month had announced a Voluntary Retirement Scheme (VRS) for all eligible workmen at the Southcan Unit in Karnataka.

Bata India shares are trading down 2.06 percent at Rs 1666.05 on BSE at 9.44 AM.

(Edited by : Asmita Pant)

First Published: Sept 13, 2023 10:41 AM IST