Both domestic or foreign traders have their eyes on the Indian banking space, particularly at a time when the Nifty Bank index has been under pressure in June so far. The index has witnessed heavy profit booking after scaling its all-time high of 44,498.60 levels on June 16, 2023.

The banking index is down about 0.43 percent in the last one month while the benchmark Nifty50 has risen about 1.18 percent. The subdued show of the Nifty Bank index is one of the reasons why Nifty50 is yet to hit its life-time high level despite hovering near it for the last few weeks.

Analysts at domestic brokerage house ICICI Securities are positive on select banking stocks but have downgraded IDFC First Bank. Axis Bank

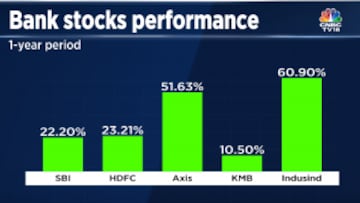

Analysts prefer IndusInd Bank, Axis Bank and HDFC Bank among large private banks and State Bank of India and Karur Vysya Bank among the public sector undertakings (PSUs) and regional banks, respectively. "We maintain our hold rating for Kotak Mahindra Bank due to MD and CEO succession and subdued RoE (return on equity). Post the recent rally, we downgrade IDFC First Bank from add to hold," the note stated.

Top picks

IndusInd Bank: Despite less than the desired three-year term extension for its MD and CEO recently, analysts prefer IndusInd for rising RoAs along with healthy growth visibility, stable NIMs and reasonable valuations.

HDFC Bank: On the other hand, analysts like HDFC Bank for its strong execution on both liabilities and advance growth, with superior track record on asset quality and return ratios. "We see the merged entity delivering impressive 1.9-2 percent RoAs, though RoEs should be optically lower at 15 percent on lower leverage but current valuations are compelling," it said.

Analysts expect re-rating for HDFC Bank post the consummation of merger with HDFC Ltd and resolution of technical issue pertaining to the ownership.

Axis Bank: With Citi deal having already consummated and front-loaded opex (operational expenditure), analysts see higher visibility of Axis Bank delivering above-industry growth along with sector-leading RoEs at 17-18 percent.

Kotak Mahindra Bank: Analysts believe KMB should continue to deliver strong advances growth though they see sharp NIMs (net interest margins) moderation off the high base, leading to moderation in RoAs going ahead. Due to the impending management succession, analysts see capped upside, driving its 'hold' rating.

SBI: Within PSU banks, analysts like SBI due to its strong retail (liability and advances) franchise, low loan-to-deposit ratio (LDR) while low net NPAs and strong provisioning coverage ratio (PCR) should ensure a strong 0.9 percent RoA and over 15 percent RoE. going ahead. SBI is also likely to be the early beneficiary of corporate capex (capital expenditure) revival and moderation in G-Sec yields, the report said.

Book value growth to remain strong

Despite the initial scare, the Indian banking system has emerged strongly post the COVID pandemic in the form of all-time high Common Equity Tier 1 (CET-1) levels, decadal-low gross or net non-performing assets and strong contingent provisions, ICICI Securities said in its research note.

FY23 has been a good year for the banking system with credit growth touching multi-year high and NIMs rising to the highest level in a decade. Strong net interest income (NII) growth has more than offset small headwinds on treasury and opex intensity, driving the highest RoAs or RoEs in the last 8-10 years.

Going ahead, analysts expect credit growth to decelerate, but still be healthy at 13-14 percent CAGR (compound annual growth rate) over FY24-25E. Post- 21-23 percent year-on-year rise in NII and core pre-provision operating profit (PPOP) in FY23, analysts see growth tapering down to 13-15 percent year-on-year in FY24E (and then improving to 15-17 percent year-on-year) for our coverage private banks.

As against the 35-40 percent year-on-year growth in the last two years, analysts see PAT (profit after tax) growth for private banks moderating to 15-16 percent for FY24/25E. "Unlike steeply rising RoAs or RoEs trajectory in the last three years, we see broadly stable RoAs or RoE for FY24-25E, which along with slight moderation in credit growth or NIMs, which could limit the re-rating potential of valuation multiples in the near term, in our view," it said.

However, strong double-digit book value growth, strong balance sheet and reasonable valuations provide comfort, believe analysts.

First Published: Jun 27, 2023 4:50 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court refuses plea seeking 6-year poll ban on PM

May 14, 2024 7:14 PM

Punjab Lok Sabha elections 2024: A look at BJP candidates

May 14, 2024 7:06 PM

Lok Sabha polls: EC disposes of 90% complaints related to MCC violations

May 14, 2024 4:45 PM

Jharkhand Lok Sabha elections 2024: All about INDIA bloc candidates

May 14, 2024 2:52 PM