The Nifty Bank — whose 12 members include the country's largest lenders SBI, HDFC Bank, Kotak Mahindra Bank, ICICI Bank and Axis Bank — touched a fresh record high on Tuesday, powering a second straight session of record highs in the headline Nifty50 index. Financial services stocks have the maximum weightage in the benchmark index, at 37 percent.

The surge in the banking index comes amid expectations of stronger participation from the sector in rallies on Dalal Street following months of consolidation.

On Monday, the Nifty50, the Sensex and the Nifty Bank — the main Indian equity indices and the heavyweight banking gauge — scaled their highest ever intraday levels in a strong upmove.

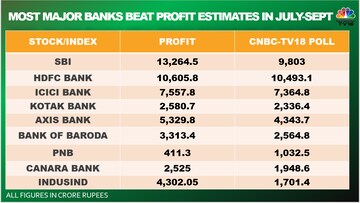

Stocks of a number of big banks have thoroughly participated in the rally.

Analysts say intermittent foreign fund inflows, a sharp drop in crude oil prices and optimism on an easing pace of COVID-era hikes in benchmark interest rates continue to drive the gains in the Indian market.

However, many experts have warned of stock valuations reaching expensive territory and expressed concerns over the impact of protests in China against COVID-related restrictions on global demand.

Is there more steam left in the heavyweight Nifty Bank?

Many analysts have positive views on the entire banking space, betting on economic activity and robust credit growth.

"I expect the Union Budget to focus on more government capital expenditure due to bouncy in tax (GST) collections... This is the last full fledged Budget before the 2024 general election," AK Prabhakar, Head of Research at IDBI Capital Markets, told CNBCTV18.com.

ALSO READ: As PSU banks rally, top fund manager describes what a 'goldmine' in the space should have

Several PSU banking stocks have outperformed their private sector peers on strong earnings and optimism on the country's festive season, which goes on till the New Year starting Diwali.

Many analysts believe PSU banking valuations are more attractive compared to those of private lenders. Haitong last month initiated coverage on India's PSU banking space, saying state-run banks are better placed owing to their gradually improving asset quality, relatively better balance sheets and higher coverage ratios.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM