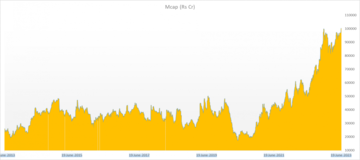

The market capitalisation of Bank of Baroda (BoB) crossed rupees one lakh crore on Monday on closing basis, despite the fact that the stock is still trading about 14 percent lower to its 2015 peak. The increase in market value can be attributed to the equity expansion seen by the bank through FY22, where the government provided capital support to restore health of public sector banks. The equity base of BoB has increased over two-fold since 2015 to the current tally of 517.14 crore.

Monday also marked the biggest gains for BoB stock in three-and-a-half months as strong economic momentum boosted investor sentiment, which lifted most stocks in PSB pack.

BoB stock, which has no "sell" rating on Bloomberg, is also the only PSB stock trading in the green in year-to-date. Shares of Bank of Baroda had generated a whopping 127 percent return in 2022 – the best returns over the last 19 years.

According to market participants, money is being chasing the public sector banks as portfolio managers are churning their portfolio, following the weakness at information technology counter.

"If you look at March, April, and May, the number with me suggests over $3 billion has come into financials, and that's partly been funded by selling nearly $1.5 billion in IT, which I think is an area to look at as well, because some of the stocks have had a massive correction," said Gautam Trivedi, Co-founder of Nepean Capital.

Bank of Baroda reported its highest ever net profit of Rs 14,110 crore in FY23. The gross and net NPAs of the bank also continue to trend downwards. Moreover, the bank managed to bring down its slippage to the guided range of 1 percent to 1.25 percent. Similarly, the credit cost of the banks has come down significantly to about 0.5 percent during the year.

JP Morgan which revised its FY24EPS estimates by 9 percent driven by lower credit cost, observed BoB’s gross slippages have moderated down to 1.4 percent with net slippage at just 0.1 percent in F23. Notably Q4 slippages were negative and credit costs were 60 basis points (bps).

While BoB, is the second public sector bank after state Bank of India (SBI) to cross the one lakh crore milestone, there are another eight public sector undertaking boasting over rupees one lakh crore of market cap as of Monday. The list include insurance behemoth LIC of India, ONGC, NTPC, Power Grid Corporation, Coal India, SBI Life Insurance, IOCL and Hindustan Aeronautics.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court dismisses plea seeking postponement of CA exams; details here

Apr 29, 2024 2:29 PM

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM

The sexual assault case against Prajwal Revanna — here's what we know so far

Apr 29, 2024 11:36 AM

Repolling underway at one polling booth in Chamarajanagar LS segment in Karnataka

Apr 29, 2024 10:32 AM