Banking and IT are the two big and critical domestic sectors, together constituting around 40 percent of Nifty50 and 35 percent of NSE-500 weights to date. Over the past decade (between 2012 and 2022), while both Nifty Bank and Nifty IT outperformed Nifty50, their performances have remained highly volatile and divergent. The divergence ranged between 10 percent and 60 percent per year, highlighted analysts at domestic brokerage house

Motilal Oswal in a research report.

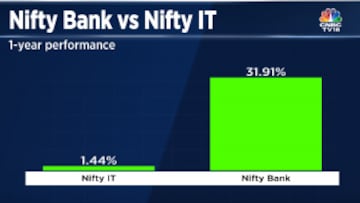

The wide divergence between the heavyweight sectors that one is used to since a decade has not played out in 2023 so far, analysts said, adding that the outperformance of Nifty IT versus

Nifty Bank has reversed since March.

Given the wide-ranging concerns on the near-term IT demand, analysts expect the trajectory for Nifty IT to remain subdued going ahead.

If one goes by Motilal, valuations for the banking sector are reasonable in the context of broader

market and that banking stocks repeating their outperformance over IT shares appears quite probable in CY 2023.

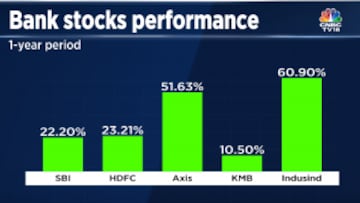

Bank stocks outperform IT shares during 3 Nifty peaks

Within the three peaks of

Nifty50 — October 2021, December 2022 and June 2023 — Nifty Bank recorded gains of 11 percent against a decline of 21 percent in Nifty IT during the same period.

"Nifty Bank has been down 1 percent from its May high, whereas Nifty IT has been down 27 percent from its January high. Hence, we note that Nifty Bank has outperformed the Nifty IT in all the scenarios of benchmark peaks over the last 21 months," Motilal noted.

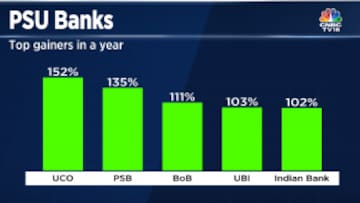

Earnings of banks spike faster than that of IT...

In FY23, earnings for Nifty Bank constituents remained strong with 38 percent year-on-year growth, whereas growth for IT constituents moderated to 7 percent year-on-year. The Nifty Bank and Nifty IT indices grew 21 percent and declined 26 percent in CY 2022, respectively.

The strong earnings momentum in Indian banks was driven by healthy loan growth, stable margins, and asset quality improvements with a sharp revival in public sector banks (PSB) profits in the second half of the decade that continued in FY23 as well.

Whereas, earnings performance of IT companies remained decent during the first half of the decade but moderated marginally in the second half. IT companies’ earnings were a mixed bag in FY23 with tier-1 firms delivering muted revenue growth and modest margins and underperforming the tier-2 companies notably.

In line with this trend, the brokerage expects earnings of Nifty Bank constituents to continue to remain strong and report 20 percent CAGR (compound annual growth rate) over FY23-25, driven by healthy credit growth and stable margins. On the other hand, earnings of Nifty IT constituents is likely to post a CAGR of 14 percent, led by margin expansion in FY24 and demand recovery in FY25E.

First Published: Jun 28, 2023 2:05 PM IST