The Indian market is not overpriced but rather aligns with its long-term valuations, according to Mark Matthews of Bank Julius Baer & Co.

With potential double-digit earnings growth next year and interest rates trending downwards, Matthews finds it challenging to envisage a decline in stock prices.

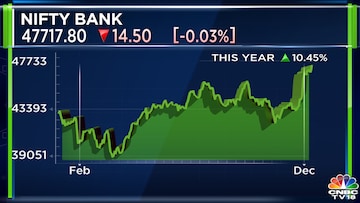

Indian benchmark indices, Nifty 50 and Sensex, opened at record highs today, December 15, and extended their gains in intraday. The Nifty 50 has gained over 27% year-to-date.

Matthews, who has been mostly bullish on the Indian market for the last couple of years, remains constructive on the banking sector. He pointed out that since the resolution of non-performing assets (NPAs) a few years ago, banks have been on a steady growth trajectory.

With limited capacity in the manufacturing sector and a burgeoning economy, banks are well-positioned to finance the increasing demands of the robust residential and commercial real estate markets, as well as the expanding infrastructure sector.

Beyond banking, Matthews is interested in the pharmaceutical sector. He noted that many patents in the pharma industry are expiring, leading to a significant rise in generic drugs, especially in markets like the United States.

Also Read

He also expressed a preference for materials, benefiting from a robust real estate market and increased infrastructure spending.

For the entire interview, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Dec 15, 2023 3:08 PM IST