Bank Julius Baer & Co maintains an optimistic perspective on the US dollar, which could arise from diverse elements like economic cues or policy choices hinting at potential dollar strengthening. Nonetheless, this favourable dollar viewpoint presents a difficulty for emerging markets such as India. However, the recent alterations in India's broader economic landscape are favourable for the Indian rupee too.

Mark Matthews from Bank Julius Baer & Co stated on CNBC-TV18 that while his organisation maintains an optimistic outlook on the US dollar, this presents challenges for emerging markets globally.

“We are constructive on the dollar and that is a headwind for emerging markets including India, no denying it. But I do think that the change in the macro landscape in India, both fiscally and current account — speaks in favour of the rupee not losing a lot of value. So, I am not that worried about the rupee,” Matthews said.

While on the Indian rupee, Lakshmanan V from

Federal Bank remarked that the Indian rupee experienced a pause in its movement against the US Dollar, reaching a peak not seen in three weeks. This occurred as the US 10-year yield eased off from its recent peak of 4.36 percent, which had been the highest in 15 years. The upcoming guidance for the market will depend on the insights shared in Fed Chair Jerome Powell's address at Jackson Hole later in the day. The bank anticipates that, in the upcoming trading sessions, the rupee's value will remain within a range of 82.36 to 83.15 per dollar.

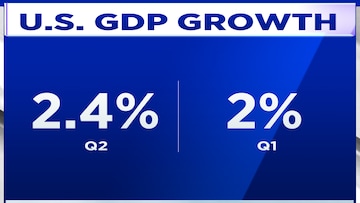

Discussing the US economy,

Daan Struyven, Managing Director and Head of Oil Research at Goldman Sachs outlined three factors supporting an optimistic growth perspective. He stated that the gross domestic product (GDP) growth is expected to slightly surpass 2 percent this year and fall just below 2 percent next year in the US. These expectations are rooted in several factors: the presence of robust momentum, favourable fundamentals, ongoing increases in real incomes, and a diminishing drag on growth due to monetary tightening measures. Additionally, the progress made in reducing core disinflation, which implies slower inflation over time, lessens the necessity for the

Federal Reserve to continue raising interest rates in our fundamental scenario.

Taking all these elements into account, Struyven asserts that there is a strong rationale for predicting a stable and gradual economic slowdown, termed a "soft landing," for the US economy.

Struyven also attributed the recent appreciation of the US dollar to renewed growth concerns from both China and Europe.

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)