Axis Bank — India's fifth largest bank by market value — is banking on higher deposits ahead to sustain its overall growth. In an interaction with CNBC-TV18, Amitabh Chaudhry, MD and CEO at Axis Bank, said it is not possible to sustain the current rate of loan growth with a lag in deposit growth.

"You cannot have a situation where deposits are growing at a single-digit rate and loan growth is racing ahead at 18-20 percent. Actually loan growth needs to follow deposit growth. There is a temporary period where you're seeing this mismatch," he said.

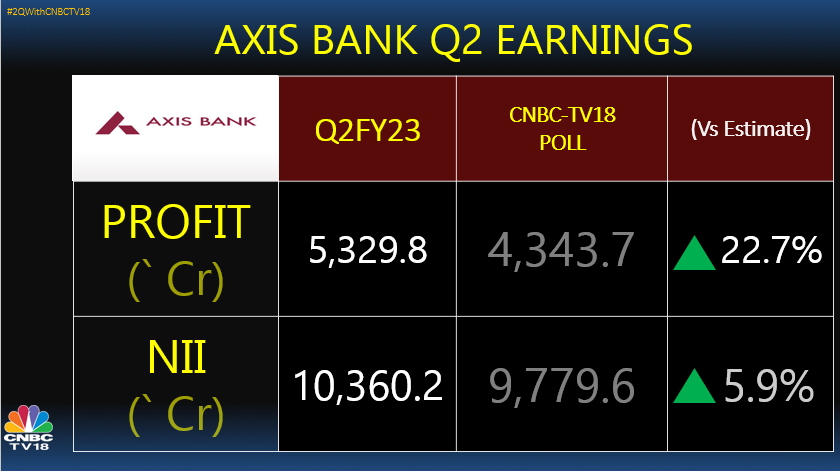

His remarks come days after Axis Bank reported a strong performance in the July-September period, with its net interest margin — a key measure of profitability for lenders — clocking the highest pace of growth in 25 quarters. The earnings announcement sent the bank's stock soaring to a 52-week high.

Chaudhry is of the view the deposit story of the entire banking system suggests low liquidity.

"Every bank is scrambling for deposits. For Axis Bank, as we go deeper, there are some pockets of further improvement, which we are working on... It is a multi-year story that we're working on. But I'm glad to say that we have already unlocked deposit growth and we should be able to sustain and accelerate it."

The lender saw its deposits grow 10.1 percent to Rs 8.1 lakh crore, with its

CASA ratio — or the proportion of low-cost deposits — hitting four-year high of 46.2 percent.

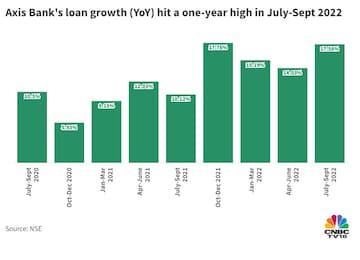

Its loan growth touched a four-quarter high of 17.5 percent.

After the release of financial results, the management said the earnings beat was backed by all-round performance across segments.

The Axis Bank CEO is optimistic Axis Bank will emerge stronger over the next 12-18 months, a period he feels will likely be tough for the entire industry.

"We had promised to the market that we are working towards a structurally sustainable net interest margin of 3.8 percent, and we have reached 3.96; we continue to optimize our balance sheet on both asset and liability sides... We should be able to sustain it over a long period of time," Chaudhry added.

Axis Bank shares have rewarded investors with a return of more than 23 percent in the past one month, a period in which the Nifty50 benchmark has risen 4.2 percent and the Nifty Bank 7.3 percent.