Indian market appears more disciplined when compared to the volatility witnessed in the US market. Despite global uncertainties and market fluctuations, Indian investors have shown resilience and maintained a disciplined approach to their investments. This disciplined outlook reflects the market's stability and potential for long-term growth.

In an interview with CNBC-TV18, Samir Arora, Founder and Fund Manager of Helios Capital shared his insights on the Indian market's performance and its positioning in comparison to the US market. Arora highlighted the discipline exhibited by the Indian market and expressed his expectations regarding interest rates and inflation targets. He also discussed the outperformance of the information technology (IT) sector, the rise of electric vehicle (EV) sales, and his recent investment decisions.

He said, “The US looks more hyper than India. I mean, India is still disciplined in the sense --- nearly half a year is over, and Nifty is up 10 percent. So that is not so out of line with any normal strong year, and therefore, I feel much more bullish that way on India right now than I am on the US.”

While talking about interest rate hikes and inflation targets, Arora said that interest rates may be hiked as the inflation target remains at 2 percent. Central banks often raise interest rates to curb inflation and maintain price stability. If inflationary pressures persist, the Reserve Bank of India (RBI) might consider tightening monetary policy through rate hikes. Such a move can impact various sectors and investment decisions in the Indian market.

On IT sector outperformance, he stated that the Indian market has witnessed a 3 percent increase with the large-cap IT sector displaying notable outperformance. The ongoing global demand for IT services and digital transformation initiatives have propelled the growth of large-cap IT companies. Additionally, the midcap IT segment has rallied in line with the overall market, indicating a balanced performance across the IT sector.

When asked about investment decisions, Arora disclosed that he has added positions in the financial and consumer sectors. These sectors play a vital role in India's economic growth, driven by factors such as increased consumer spending and expanding financial services. Arora also revealed his recent investment in Hindustan Petroleum Corporation Limited (HPCL), suggesting his confidence in the potential of the energy sector.

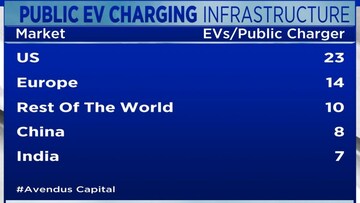

Highlighting a significant trend in

electric vehicles, Arora mentioned that several automakers are substituting internal combustion engine (ICE) car sales with EV sales. The growing demand for electric vehicles and the shift towards sustainable transportation solutions has prompted automotive companies to focus on EV production.

Talking further about investments to stay in the EV business, Arora emphasized that EV investments are being made to ensure companies stay relevant and competitive. The rapid advancement of

EV technology and changing consumer preferences have made it crucial for automotive manufacturers to adapt to the EV revolution.

“These investments are being made to remain in business, these investments are required because the environment or the government or the public has asked these companies to change their technology and make new cars,” he said.

However, said Arora, from an economic perspective, it essentially entails capital destruction since the previous investment made in manufacturing cars is rendered obsolete, requiring additional expenditure to produce a completely different set of cars. This financial outlay will not be recouped; there is no possibility of recovering the spent funds. The objective is solely to remain competitive in the industry.

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)