Andrew Holland, CEO of Avendus Capital Public Markets Alternate Strategies expects the Reserve Bank of India's (RBI) Monetary Policy Committee to follow the US Federal Reserve's hawkish stance.

The six-member MPC headed by Governor Shaktikanta Das will announce the fourth RBI monetary policy this fiscal at 10 am on October 6 after a three-day meet starting October 4. The repo rate -- the rate at which RBI lends money to commercial banks -- has been unchanged at 6.5 percent since February.

In an interview with CNBC-TV18, Holland also spoke about his expectations on the market in the near term as well as the oncoming earnings season.

Holland said, “It’s a wide range, I think, lows of 19,000 and the highs of 20,000."

The next trigger, he believes, could be if some of the local elections are more favourable, or as we go into next year as the general elections and optimism towards that starts to pick up in terms of momentum for the Indian index.

On the IT sector earnings

He pointed out the possibility of additional downgrades in the earnings of the information technology (IT) sector.

“I am not convinced that the

IT sector is out of its problems yet, and we might see some more downgrades to earnings. That would probably be the time I would be looking more seriously at the IT sector, but at this moment I do not think there is any need to rush into it," he said.

He believes IT is not going to be a driver of the India index anytime soon.

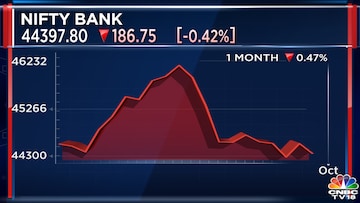

On banking sector performance

While the economy and loan growth is in positive territory, Holland said there appears to be an obstacle preventing the banking sector from fully capitalising on these favourable conditions.

“I think let's wait for the result season because that will tell us a lot more of what we need to do in this sector because it should be outperforming, the

economy is doing well, the loan growth is doing well, but there is something that is holding back the banking sector. So, the story will be unfolding as results come out,” said Holland.

For more details, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Oct 3, 2023 2:51 PM IST