Brokerage firm CLSA believes that the recent correction seen in Amber Enterprises is a good buying opportunity and upgraded the stock to "buy" from its earlier rating of "accumulate."

CLSA also raised its price target on Amber Enterprises to ₹4,300 from ₹4,130 earlier.

Shares of Amber Enterprises are down 26% from their peak of ₹4,614.

CLSA said the weakness in the stock, which is likely driven by the ongoing subdued sentiments in the broader markets or expectations of modest near-term earnings, is overdone.#CNBCTV18Market | CLSA upgrades to buy call on Amber Enterprises. Says recent share price correction (-14% in 1 month) provides an attractive entry point pic.twitter.com/4Fyx34fOYY

— CNBC-TV18 (@CNBCTV18Live) March 22, 2024

The brokerage also said that its medium-term thesis of growth in the non-room air conditioner segment remains intact. It also assumes that while RAC market share would fall 19% by financial year 2030 and another 10% by financial year 2040, other segments of the company will contribute to half of the company's revenue in the next five years.

Last week, the Gurgaon-based solution provider for the heating, ventilation and air conditioner (HVAC) industry, told CNBC-TV18 that it is targeting doubling of electronic segments revenues within the next two financial years.

“We are quite optimistic in the electronic segment, and we have acquired Ascent Circuits 60% stake, which strengthens our electronic EMS portfolio for the backward integration," said Jasbir Singh, Chairman & CEO, Amber Enterprises.

Singh anticipates total addressable market of printed circuit boards (PCB) to be at $25-30 billion in the next five years.

In the April-December 2023 period, the electronics segment contributed around ₹757 crore or roughly 19% to Amber's overall sales of ₹3,924 crore. The share is expected to increase to 25-30% in the next two years.

The consumer durables segment remained the largest contributor to sales at 72% during April-December, while the balance 9% comes from the railways business.

The contribution of room air conditioners, which is currently around 38% of the consolidated revenue, will come down to 30% in the next financial year, he said.

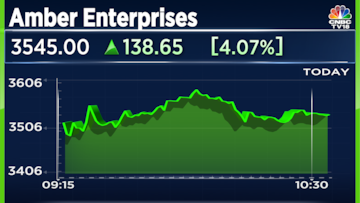

Amber Enterprises shares were trading 3.3% higher at ₹3,523. The stock is up 87% over the last 12 months.

(Edited by : Hormaz Fatakia)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!