Aditya Birla Capital's recent announcement of a merger with its non-banking finance company (NBFC) subsidiary, Aditya Birla Finance Limited (ABFL), has sparked optimism among financial analysts. Brokerage firms Morgan Stanley and Jefferies have weighed in on the potential implications of this move.

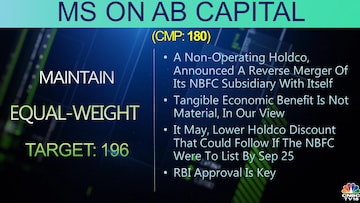

While Morgan Stanley has maintained an 'Equal-Weight' call with a target price of ₹196 per share, Jefferies is notably bullish, upgrading its call to 'Buy' and raising the target price to ₹225 per share.

Morgan Stanley perceives this merger as having a limited tangible economic benefit.

However, the brokerage acknowledges the potential impact on the Holdco discount, which could be alleviated if ABFL were to list independently before the September 25 deadline.

Holdco discount refers to a reduction in the valuation or market price of Aditya Birla Capital's shares due to its status as a holding company (Holdco) with diverse subsidiaries, including the non-banking financial company (NBFC) subsidiary, Aditya Birla Finance Limited (ABFL).

Holdco discounts often arise because investors may perceive holding companies as less valuable than individual business units or subsidiaries.

The crucial factor for this strategic manoeuvre lies in securing approval from the Reserve Bank of India (RBI).

Jefferies, on the other hand, stresses the significance of the proposed merger, emphasising its potential to simplify the corporate structure and resolve the impending mandatory listing of ABFL by September 2025.

The merger is projected to lift the Capital Adequacy Ratio (CRAR) by 150 basis points, signalling enhanced financial stability.

However, Jefferies also notes the possibility of Aditya Birla Capital trimming its stake in Aditya Birla Sun Life Insurance (ABSLI) from the current 51% to comply with the 50% cap on holding.

The removal of the Holdco discount on ABFL is expected to boost the Sum of the Parts (SOTP) valuation by 12%.

At the time of writing this report, shares of Aditya Birla Capital were trading 3.28% higher at ₹185.55 apiece.

(Edited by : Amrita)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!