Adani Wilmar's shares declined 2 percent on Thursday after the company reported its earnings for the June quarter with margins for edible oil falling to 1.8 percent from 2.4 percent year-on-year (YoY) owing to inflationary pressures.

The stock was trading 1.25 percent lower at Rs 689 per share on BSE at the time of writing. In the last one month, the stock has gained 18.38 percent.

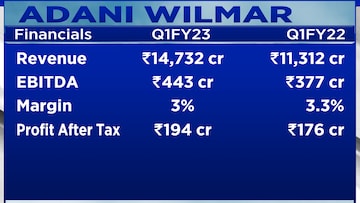

Overall, the company reported a decent set of numbers for the first quarter on YoY basis with the revenue rising 30 percent to Rs 14,731.62 crore as compared to Rs 11,311.97 crore during the same period last year.

The EBITDA or earnings before interest, taxes, depreciation, and amortization rose 17 percent to Rs 443 crore from Rs 377 crore last year while the margins stood at 3 percent versus 3.3 in the year-ago period. Profit after tax (PAT) grew 10 percent to Rs 193.59 crore. It was Rs 175.7 a year ago.

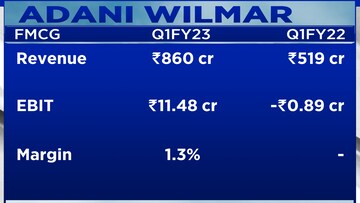

Volumes grew 15 percent YoY to 1.19 million metric tonnes with edible oil business seeing a growth of 6 percent and FMCG volumes rising 53 percent.

However, on a quarter-on-quarter basis, the company's revenue declined 2 percent and net profit fell 17 percent. Margins improved from 2.8 percent on price hikes and as inflation in palm oil prices started to cool off.

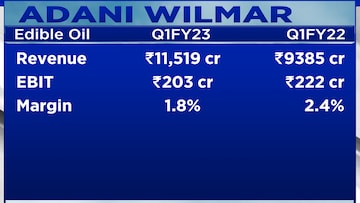

The revenue for edible oil segment grew 13 percent to Rs 11,518 crore from Rs 9,385 crore last year, however, the earnings before interest and taxes (EBIT) fell 9 percent from Rs 222.48 crore to Rs 203 crore. Revenue from edible oil business is down 7.2 percent QoQ.

The company said that its edible oil market share stood at 18.7 percent.

Inflationary pressure was a key concern for the edible oil industry, said the company, adding that there has been some respite due to the softening of certain commodity prices.

As festivities begin, the company expects an uptick in the demand going forward in the second quarter.

"We expect uptick in the demand in Q2 FY23 on the back of festivities and weddings across the country. We particularly expect growth in demand from rural markets, with expectations of a good monsoon," said Angshu Mallick, MD and CEO, Adani Wilmar

Revenue from FMCG business is up 13.65 percent to Rs 859.98 crore QoQ.

“Adani Wilmar has continued to demonstrate a steady growth on overall volumes, led by an exceptional growth in the foods business. This is despite multiple headwinds that we saw during the quarter with inflation and low consumer offtake being the major concern areas," added Mallick.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM