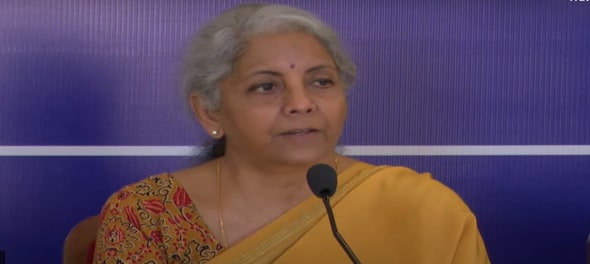

The scope and validity of the Emergency Credit Line Guarantee Scheme (ECLGS) has been extended till March 31, 2023, Finance Minister Nirmala Sitharaman said.

The government has extended relief for Hospitality, Civil Aviation and related enterprises under the ECLGS.

The government has also increased additional credit support from existing 40 percent of fund-based credit outstanding to 50 percent of fund and non-fund based credit outstanding under ECLGS 3.0, the Finance Minister said.

Eligible borrowers in the civil aviation sector are now permitted to avail of non-fund based emergency credit facilities, Sitharaman added.

While presenting her fourth budget on February 1, 2022, for the financial year 2022-23, Finance Minister Nirmala Sitharaman had said guarantee cover for ECLGS would will be expanded by Rs 50,000 crore to a total of Rs 5 lakh crore.

The ECLGS was launched by the government as part of its Rs 20 lakh crore comprehensive package, which was announced by the Finance Ministry on May 13, 2020.

The Economic Survey had said that till November 19, 2021, a total amount of Rs 2.28 lakh crore was disbursed to 95.2 lakh borrowers, impacting 5.45 crore employees.

In May last year, founder and CEO of Martin Consulting Mark D Martin, had said that the support for the aviation industry was not enough.

"I do not see this emergency credit lend borrowing initiative being any great support; it’s just enough to soften the blow to take care of salaries but the major development cost, which is going to be at least Rs 3,000-4,000 crore is still a gap,” Martin had told CNBC-TV18 in an interview.

First Published: Mar 30, 2022 6:30 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Thiruvananthapuram Lok Sabha Elections: Congress’ Shashi Tharoor eyes fourth consecutive term

Apr 26, 2024 6:38 AM

Lok Sabha elections 2024 Phase 2 Voting Live: Polling to begin at 7 am; Rahul, Tharoor, Hema Malini in fray

Apr 26, 2024 6:20 AM

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM